- Recently, Time Series Forecasting (TSF) has gained a lot of attention as the go-to strategy across various industry sectors (sales, stock prices, meteorology, energy consumption, marketing, etc.). TSF is used to forecast trends, seasonality, and other patterns in time series data.

- In this post, we will compare several popular TSF methods in terms of their forecasting performance on a set of 4 real-world time series: Air Passengers, the U.S. Wholesale Price Index (WPI), BTC-USD price, and the Peyton Manning. Our evaluation will involve assessing the quality of the TSF and determining whether it is accurate and reliable. This may involve comparing the forecast to the actual values and using statistical performance measures, such as MAE, MAPE and RMSE, to evaluate its performance.

- Some advanced TSF models are ThymeBoost, Prophet, and AutoARIMA (pmdarima). These methods are based on historical data and build statistical models to identify patterns and trends in the data.

- In fact, several studies have shown that ThymeBoost outperforms traditional TSF models: Tyler Blume recently explored the ThymeBoost framework and compared its auto-forecasting performance to some of its peers.

- ThymeBoost is based on machine learning (ML) algorithms, including gradient boosting (GB) and deep learning. It combines time series decomposition with ML/GB to provide a balanced mix-and-match forecasting.

- At the most granular level are the trend, seasonal, and endogenous models. The key features of ThymeBoost include automation, multiple modeling options, performance evaluation, and tuning.

- Continue reading about the aforementioned TSF models and related feature engineering methods.

Table of Contents

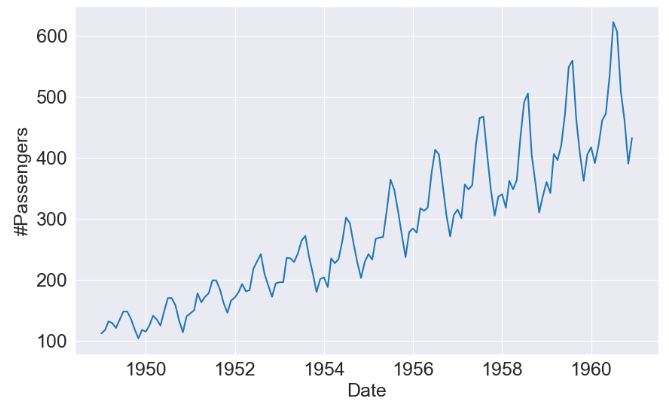

Air Passengers

- Let’s begin with the most popular Airline Passenger dataset.

- Setting the working directory YOURPATH, importing the key libraries, and reading the input data

import os

os.chdir('YOURPATH')

os. getcwd()

!pip install ThymeBoost --upgrade

import numpy as np

import pandas as pd

from matplotlib import pyplot as plt

from ThymeBoost import ThymeBoost as tb

import seaborn as sns

sns.set_style("darkgrid")

plt.rcParams.update({'font.size': 18})

plt.figure(figsize=(10,6))

df = pd.read_csv('AirPassengers.csv')

df.index = pd.to_datetime(df['Month'])

y = df['#Passengers']

plt.xlabel('Date')

plt.ylabel('#Passengers')

plt.plot(y)

plt.show()

- Train/test data splitting as 70:30%

test_len = int(len(y) * 0.3)

al_train, al_test = y.iloc[:-test_len], y.iloc[-test_len:]

- Fitting a simple AutoARIMA model

import pmdarima as pm

arima = pm.auto_arima(al_train,

seasonal=True,

m=12,

trace=True,

error_action='warn',

n_fits=50)

pmd_predictions = arima.predict(n_periods=len(al_test))

arima_mae = np.mean(np.abs(al_test - pmd_predictions))

arima_rmse = (np.mean((al_test - pmd_predictions)**2))**.5

arima_mape = np.sum(np.abs(pmd_predictions - al_test)) / (np.sum((np.abs(al_test))))

Performing stepwise search to minimize aic

ARIMA(2,1,2)(1,1,1)[12] : AIC=654.029, Time=0.47 sec

ARIMA(0,1,0)(0,1,0)[12] : AIC=657.288, Time=0.01 sec

ARIMA(1,1,0)(1,1,0)[12] : AIC=650.553, Time=0.06 sec

ARIMA(0,1,1)(0,1,1)[12] : AIC=651.123, Time=0.12 sec

ARIMA(1,1,0)(0,1,0)[12] : AIC=652.376, Time=0.02 sec

ARIMA(1,1,0)(2,1,0)[12] : AIC=652.523, Time=0.18 sec

ARIMA(1,1,0)(1,1,1)[12] : AIC=652.538, Time=0.13 sec

ARIMA(1,1,0)(0,1,1)[12] : AIC=650.954, Time=0.10 sec

ARIMA(1,1,0)(2,1,1)[12] : AIC=inf, Time=1.26 sec

ARIMA(0,1,0)(1,1,0)[12] : AIC=653.919, Time=0.06 sec

ARIMA(2,1,0)(1,1,0)[12] : AIC=652.418, Time=0.10 sec

ARIMA(1,1,1)(1,1,0)[12] : AIC=651.963, Time=0.11 sec

ARIMA(0,1,1)(1,1,0)[12] : AIC=650.738, Time=0.07 sec

ARIMA(2,1,1)(1,1,0)[12] : AIC=653.897, Time=0.16 sec

ARIMA(1,1,0)(1,1,0)[12] intercept : AIC=652.271, Time=0.17 sec

Best model: ARIMA(1,1,0)(1,1,0)[12]

Total fit time: 3.060 seconds

print (arima_mae)

print (arima_rmse)

print (arima_mape)

2.3930597256495694

2.8132108675986482

0.022076196808772784

- Fitting the multiplicative Prophet model

from prophet import Prophet

prophet_train_df = al_train.reset_index()

prophet_train_df.columns = ['ds', 'y']

prophet = Prophet(seasonality_mode='multiplicative')

prophet.fit(prophet_train_df)

future_df = prophet.make_future_dataframe(periods=len(al_test), freq='M')

prophet_forecast = prophet.predict(future_df)

prophet_predictions = prophet_forecast['yhat'].iloc[-len(al_test):]

prophet_mae = np.mean(np.abs(al_test - prophet_predictions.values))

prophet_rmse = (np.mean((al_test - prophet_predictions.values)**2))**.5

prophet_mape = np.sum(np.abs(prophet_predictions.values - al_test)) / (np.sum((np.abs(al_test))))

print (prophet_mae)

print (prophet_rmse)

print (prophet_mape)

8.315019543856259

9.230116817444786

0.07670682263023607

- Fitting the ThymeBoost model

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.autofit(al_train,

seasonal_period=12)

predicted_output = boosted_model.predict(output, len(al_test))

tb_mae = np.mean(np.abs(al_test - predicted_output['predictions']))

tb_rmse = (np.mean((al_test - predicted_output['predictions'])**2))**.5

tb_mape = np.sum(np.abs(predicted_output['predictions'] - al_test)) / (np.sum((np.abs(al_test))))

Optimal model configuration: {'trend_estimator': ['linear', 'ses'], 'fit_type': 'global', 'seasonal_period': [12], 'arima_order': None, 'seasonal_estimator': 'fourier', 'global_cost': 'mse', 'additive': False, 'seasonality_weights': array([ 2, 2, 2, 2, 2, 2, 2, 2, 2, 2, 2, 2, 3, 3, 3, 3, 3,

3, 3, 3, 3, 3, 3, 3, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4,

4, 4, 5, 5, 5, 5, 5, 5, 5, 5, 5, 5, 5, 5, 6, 6, 6,

6, 6, 6, 6, 6, 6, 6, 6, 6, 7, 7, 7, 7, 7, 7, 7, 7,

7, 7, 7, 7, 8, 8, 8, 8, 8, 8, 8, 8, 8, 8, 8, 8, 9,

9, 9, 9, 9, 9, 9, 9, 9, 9, 9, 9, 10, 10, 10, 10, 10]), 'exogenous': None}

Params ensembled: False

print (tb_mae)

print (tb_rmse)

print (tb_mape)

44.2778947853649

50.34661221952847

0.10477379901885817

- Plotting model components

plt.rcParams.update({'font.size': 18})

plt.figure(figsize=(10,15))

boosted_model.plot_components(output, predicted_output)

- Plotting actuals, pmdarima, prophet, and ThymeBoost (TB) for the test data

plt.rcParams.update({'font.size': 18})

plt.figure(figsize=(10,6))

plt.plot(pmd_predictions, label='Pmdarima')

plt.plot(pmd_predictions.index,al_test.values, label='Actuals')

plt.plot(pmd_predictions.index,prophet_predictions.values, label='Prophet')

plt.plot(pmd_predictions.index,predicted_output['predictions'].values, label='ThymeBoost')

plt.xlabel('Date')

plt.ylabel('#Passengers')

plt.legend()

plt.show()

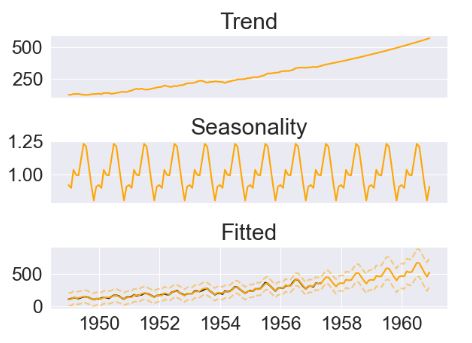

U.S. WPI

- The 2nd dataset is the U.S. Wholesale Price Index (WPI) from 1960 to 1990 and the example is taken from the aforementioned article.

from statsmodels.datasets import webuse

plt.rcParams.update({'font.size': 18})

plt.figure(figsize=(10,6))

dta = webuse('wpi1')

ts_wpi = dta['wpi']

ts_wpi.index = pd.to_datetime(dta['t'])

test_len = int(len(ts_wpi) * 0.1)

ts_wpi = ts_wpi.astype(float)

wpi_train, wpi_test = ts_wpi.iloc[:-test_len], ts_wpi.iloc[-test_len:]

plt.xlabel('Date')

plt.ylabel('WPI')

plt.plot(ts_wpi)

plt.show()

- Fitting the AutoARIMA model

import pmdarima as pm

# Fit a simple auto_arima model

arima = pm.auto_arima(wpi_train,

seasonal=False,

trace=True,

error_action='warn',

n_fits=50)

pmd_predictions = arima.predict(n_periods=len(wpi_test))

arima_mae = np.mean(np.abs(wpi_test - pmd_predictions))

arima_rmse = (np.mean((wpi_test - pmd_predictions)**2))**.5

arima_mape = np.sum(np.abs(pmd_predictions - wpi_test)) / (np.sum((np.abs(wpi_test))))

Performing stepwise search to minimize aic

ARIMA(2,2,2)(0,0,0)[0] intercept : AIC=233.402, Time=0.24 sec

ARIMA(0,2,0)(0,0,0)[0] intercept : AIC=245.760, Time=0.02 sec

ARIMA(1,2,0)(0,0,0)[0] intercept : AIC=233.922, Time=0.02 sec

ARIMA(0,2,1)(0,0,0)[0] intercept : AIC=229.373, Time=0.04 sec

ARIMA(0,2,0)(0,0,0)[0] : AIC=243.762, Time=0.01 sec

ARIMA(1,2,1)(0,0,0)[0] intercept : AIC=230.888, Time=0.04 sec

ARIMA(0,2,2)(0,0,0)[0] intercept : AIC=230.976, Time=0.04 sec

ARIMA(1,2,2)(0,0,0)[0] intercept : AIC=inf, Time=0.19 sec

ARIMA(0,2,1)(0,0,0)[0] : AIC=227.412, Time=0.02 sec

ARIMA(1,2,1)(0,0,0)[0] : AIC=228.930, Time=0.03 sec

ARIMA(0,2,2)(0,0,0)[0] : AIC=229.018, Time=0.03 sec

ARIMA(1,2,0)(0,0,0)[0] : AIC=231.935, Time=0.01 sec

ARIMA(1,2,2)(0,0,0)[0] : AIC=inf, Time=0.14 sec

Best model: ARIMA(0,2,1)(0,0,0)[0]

Total fit time: 0.860 seconds

print (arima_mae)

print (arima_rmse)

print (arima_mape)

2.3930597256495694

2.8132108675986482

0.022076196808772784

- Fitting the Prophet model

from prophet import Prophet

prophet_train_df = wpi_train.reset_index()

prophet_train_df.columns = ['ds', 'y']

prophet = Prophet(yearly_seasonality=False)

prophet.fit(prophet_train_df)

future_df = prophet.make_future_dataframe(periods=len(wpi_test))

prophet_forecast = prophet.predict(future_df)

prophet_predictions = prophet_forecast['yhat'].iloc[-len(wpi_test):]

prophet_mae = np.mean(np.abs(wpi_test - prophet_predictions.values))

prophet_rmse = (np.mean((wpi_test - prophet_predictions.values)**2))**.5

prophet_mape = np.sum(np.abs(prophet_predictions.values - wpi_test)) / (np.sum((np.abs(wpi_test))))

print (prophet_mae)

print (prophet_rmse)

print (prophet_mape)

8.315019543856259

9.230116817444786

0.07670682263023607

- Fitting the ThymeBoost model

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.autofit(wpi_train,

seasonal_period=0)

predicted_output = boosted_model.predict(output, forecast_horizon=len(wpi_test))

tb_mae = np.mean(np.abs((wpi_test.values) - predicted_output['predictions']))

tb_rmse = (np.mean((wpi_test.values - predicted_output['predictions'].values)**2))**.5

tb_mape = np.sum(np.abs(predicted_output['predictions'].values - wpi_test.values)) / (np.sum((np.abs(wpi_test.values))))

Optimal model configuration: {'trend_estimator': ['linear', 'ses'], 'fit_type': 'global', 'seasonal_period': 0, 'arima_order': None, 'seasonal_estimator': 'fourier', 'global_cost': 'mse', 'additive': False, 'exogenous': None}

Params ensembled: False

print(boosted_model.optimized_params)

{'trend_estimator': ['linear', 'ses'], 'fit_type': 'global', 'seasonal_period': 0, 'arima_order': None, 'seasonal_estimator': 'fourier', 'global_cost': 'mse', 'additive': False, 'exogenous': None}

print (tb_mae)

print (tb_rmse)

print (tb_mape)

1.8009677718849417

2.4801489070703315

0.0166140938950435

- Comparing the TSF results vs actuals

plt.rcParams.update({'font.size': 18})

plt.figure(figsize=(16,6))

plt.plot(pmd_predictions.index,pmd_predictions, label='Pmdarima')

plt.plot(pmd_predictions.index,wpi_test.values, label='Actuals')

plt.plot(pmd_predictions.index,prophet_predictions.values, label='Prophet')

plt.plot(pmd_predictions.index,predicted_output['predictions'].values, label='ThymeBoost')

plt.xlabel('Date')

plt.ylabel('WPI')

plt.legend()

plt.show()

BTC-USD

- Let’s look at the BTC-USD TSF by modifying the ThymeBoost code with various QC options

from ThymeBoost import ThymeBoost as tb

import seaborn as sns

sns.set_style('darkgrid')

import yfinance as yf

msft = yf.Ticker("BTC-USD")

# get historical market data

hist = msft.history(period="max")

current_df = hist.iloc[-900:-50].reset_index()

future_df = hist.iloc[-50:].reset_index()

y_train = current_df['High']

X_train = current_df[['Volume', 'Stock Splits']]

y_test = future_df['High']

X_test = future_df[['Volume', 'Stock Splits']]

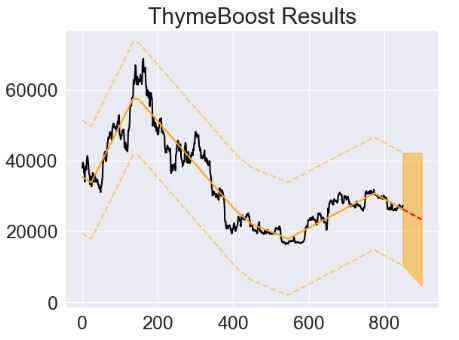

- Fitting the ThymeBoost model with the ARIMA trend

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator='arima',

arima_order=(2,1,2),

global_cost='mse',

fit_type='global',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

plt.figure(figsize=(16,6))

boosted_model.plot_results(output, predicted_output)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_components(output, predicted_output)

- Fitting the ThymeBoost model with the Linear + ARIMA trend

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator=['linear', 'arima'],

arima_order=(2,1,2),

global_cost='mse',

fit_type='global',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

- Fitting the ThymeBoost model with the Linear + ARIMA trend and arima_order=’auto’

boosted_model = tb.ThymeBoost(verbose=1)

output = boosted_model.fit(y_train,

trend_estimator=['linear', 'arima'],

arima_order='auto',

global_cost='mse',

fit_type='global',

)

predicted_output = boosted_model.predict(output, 50)

********** Round 1 **********

Using Split: None

Fitting initial trend globally with trend model:

median()

seasonal model:

None

cost: 165160095.1694897

********** Round 2 **********

Using Split: None

Fitting global with trend model:

linear((1, None))

seasonal model:

None

cost: 86426761.83257383

********** Round 3 **********

Using Split: None

Fitting global with trend model:

arima(auto)

seasonal model:

None

cost: 1080981.535484013

==============================

Boosting Terminated

Using round 3

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

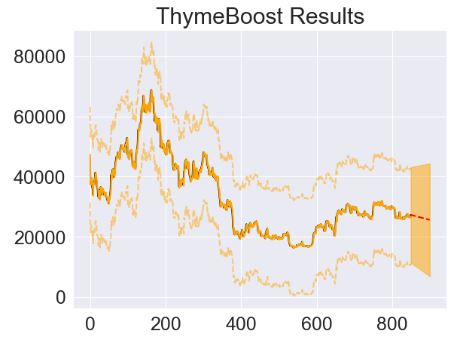

- Revisiting the ThymeBoost model optimization based on the Exogeneous example code

from ThymeBoost import ThymeBoost as tb

import yfinance as yf

msft = yf.Ticker("BTC-USD")

# get historical market data

hist = msft.history(period="max")

current_df = hist.iloc[-900:-50].reset_index()

future_df = hist.iloc[-50:].reset_index()

y_train = current_df['High']

X_train = current_df[['Volume', 'Stock Splits']]

y_test = future_df['High']

X_test = future_df[['Volume', 'Stock Splits']]

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator=['linear','ses'],

seasonal_estimator='fourier',

global_cost='mse',

exogenous_estimator='ols',

fit_type=['local', 'global'],

exogenous=X_train,

)

predicted_output = boosted_model.predict(output, 50, future_exogenous=X_test)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

plt.rcParams.update({'font.size': 18})

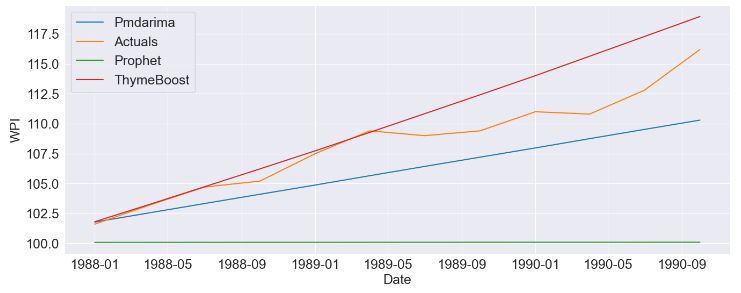

boosted_model.plot_components(output, predicted_output)

- Fitting the ThymeBoost exogeneous model with rolling optimization

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.optimize(y_train,

trend_estimator=[['linear','ses'], 'linear'],

seasonal_estimator=['fourier'],

global_cost=['mse'],

exogenous_estimator=['ols', 'decision_tree'],

fit_type=[['local', 'global'], 'global'],

exogenous=[X_train, None],

optimization_strategy='rolling',

lag=32,

optimization_steps=8

)

Optimal model configuration: {'trend_estimator': ['linear', 'ses'], 'fit_type': ['local', 'global'], 'seasonal_period': None, 'seasonal_estimator': 'fourier', 'global_cost': 'mse', 'exogenous_estimator': 'ols', 'exogenous': Volume Stock Splits

0 34639423297 0

1 33070867190 0

2 35460750427 0

3 41831090187 0

4 35959473399 0

.. ... ...

845 8192867686 0

846 11997833257 0

847 9985498161 0

848 11718380997 0

849 14079002707 0

[850 rows x 2 columns]}

Params ensembled: False

plt.rcParams.update({'font.size': 18})

boosted_model.plot_optimization(output)

predicted_output = boosted_model.predict(output, 50, future_exogenous=X_test)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

- Let’s optimize the ThymeBoost TSF using both linear and polynomial trends with multiple change points (cf. code)

from ThymeBoost import ThymeBoost as tb

import seaborn as sns

sns.set_style('darkgrid')

import yfinance as yf

msft = yf.Ticker("BTC-USD")

# get historical market data

hist = msft.history(period="max")

current_df = hist.iloc[-900:-50].reset_index()

future_df = hist.iloc[-50:].reset_index()

y_train = current_df['High']

X_train = current_df[['Volume', 'Stock Splits']]

y_test = future_df['High']

X_test = future_df[['Volume', 'Stock Splits']]

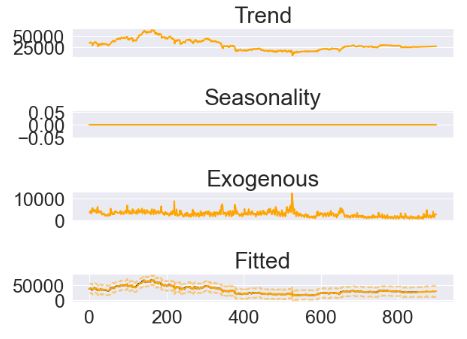

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator='linear',

global_cost='mse',

fit_type='global',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

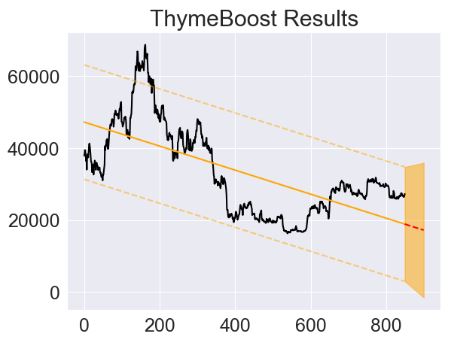

- Fitting the ThymeBoost model using the global parabolic regression

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator='linear',

poly=2,

global_cost='mse',

fit_type='global',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

- Fitting the ThymeBoost model using the local 3rd order polynomial regression

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator='linear',

poly=3,

global_cost='mse',

fit_type='local',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

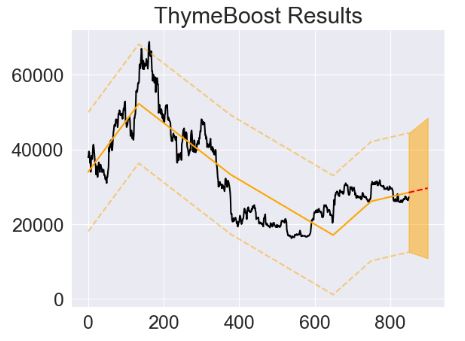

- Fitting the ThymeBoost model using the local 2rd order polynomial regression

boosted_model = tb.ThymeBoost(verbose=0)

output = boosted_model.fit(y_train,

trend_estimator='linear',

poly=2,

global_cost='maicc',

fit_type='local',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

- Fitting the ThymeBoost model using the local linear regression with split_strategy=’gradient’

boosted_model = tb.ThymeBoost(verbose=0,

approximate_splits=True,

n_split_proposals=50,

split_strategy='gradient')

output = boosted_model.fit(y_train,

trend_estimator='linear',

poly=1,

global_cost='maicc',

fit_type='local',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

- Fitting the ThymeBoost model using the local linear regression with approximate_splits=False

boosted_model = tb.ThymeBoost(verbose=0,

approximate_splits=False)

output = boosted_model.fit(y_train,

trend_estimator='linear',

poly=1,

global_cost='maicc',

fit_type='local',

)

predicted_output = boosted_model.predict(output, 50)

plt.rcParams.update({'font.size': 18})

boosted_model.plot_results(output, predicted_output)

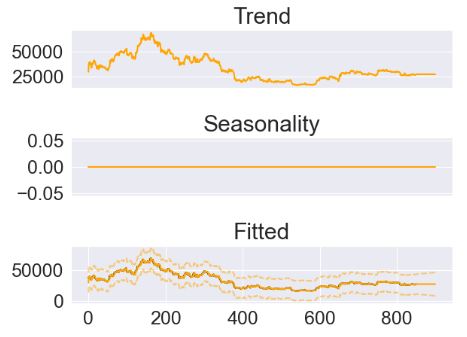

Peyton Manning

import pandas as pd

import matplotlib.pyplot as plt

from prophet import Prophet

import numpy as np

import seaborn as sns

sns.set_style('darkgrid')

df = pd.read_csv('https://raw.githubusercontent.com/facebook/prophet/main/examples/example_wp_log_peyton_manning.csv')

plt.rcParams.update({'font.size': 14})

plt.figure(figsize=(14,10))

m = Prophet(weekly_seasonality=True)

m.fit(df)

future = m.make_future_dataframe(periods=2 * 365)

forecast = m.predict(future)

m.plot(forecast)

m.plot_components(forecast)

plt.show()

- Fitting the ThymeBoost model with 25 change points and trend_estimator=[‘lbf’]

from ThymeBoost import ThymeBoost as tb

boosted_model = tb.ThymeBoost(verbose=1,

n_rounds=None)

output = boosted_model.fit(df['y'].values,

seasonal_period=[365],

trend_estimator=['lbf'],

n_changepoints=25

)

predicted_output = boosted_model.predict(output,

365 * 2)

********** Round 1 **********

Using Split: None

Fitting initial trend globally with trend model:

median()

seasonal model:

fourier(10, False)

cost: -2341.8470210049586

********** Round 2 **********

Using Split: None

Fitting global with trend model:

lbf(25)

seasonal model:

fourier(10, False)

cost: -3283.6285756724137

==============================

Boosting Terminated

Using round 2

plt.rcParams.update({'font.size': 14})

plt.figure(figsize=(14,10))

boosted_model.plot_results(output, predicted_output)

boosted_model.plot_components(output, predicted_output)

![Fitting the ThymeBoost model with 25 change points and trend_estimator=['lbf']](https://newdigitals.org/wp-content/uploads/2023/11/tb_forecast.jpg?w=481)

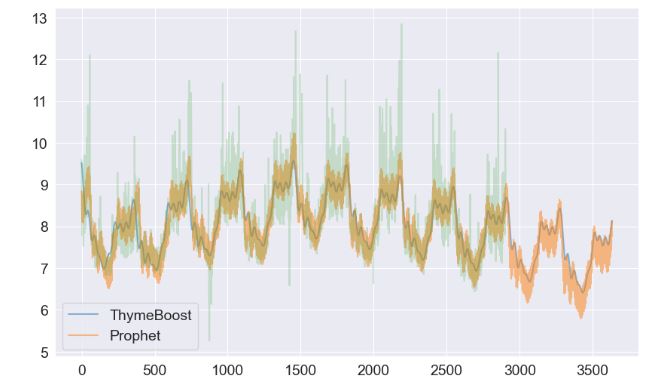

- Comparing trends predicted by Prophet and ThymeBoost

plt.rcParams.update({'font.size': 14})

plt.figure(figsize=(10,6))

plt.plot(np.append(output['trend'].values, predicted_output['predicted_trend'].values), label='ThymeBoost')

plt.plot(forecast['trend'], label='Prophet')

plt.legend()

plt.show()

- Comparing yearly seasonality predicted by ThymeBoost and Prophet

plt.rcParams.update({'font.size': 14})

plt.figure(figsize=(10,6))

plt.plot(np.append(output['seasonality'].values, predicted_output['predicted_seasonality'].values), label='ThymeBoost', alpha=.5)

plt.plot(forecast['additive_terms'], label='Prophet', alpha=.5)

plt.legend()

- Comparing time series predicted by ThymeBoost and Prophet

plt.rcParams.update({'font.size': 14})

plt.figure(figsize=(10,6))

plt.plot(np.append(output['yhat'].values, predicted_output['predictions'].values), label='ThymeBoost', alpha=.5)

plt.plot(forecast['yhat'], label='Prophet', alpha=.5)

plt.plot(df['y'].values, alpha=.2)

plt.legend()

Summary

- This study evaluates AutoARIMA, Facebook Prophet and ThymeBoost in terms of their forecasting performance on a set of 4 real-world time series: Air Passengers, the U.S. Wholesale Price Index (WPI), BTC-USD price, and the Peyton Manning.

- ThymeBoost is a Python library typically used in ML/AI applications. It combines the traditional decomposition process with gradient boosting to provide a flexible mix-and-match time series framework for trend/seasonality/endogenous decomposition and TSF. ThymeBoost supports a range of different modeling techniques, including gradient boosting, deep learning, and classical statistical models, allowing users to choose the most appropriate method for their data and forecasting needs.

- Prophet is a TSF library that can handle missing data, seasonality, and trends in the data. The TSF model can be tuned by adjusting trends, seasonality, and holidays.

- An ARIMA (autoregressive integrated moving average) model is a type of statistical model that is used to analyze and forecast time series data. It is a combination of three different models: an autoregressive (AR) model, an integrated (I) model, and a moving average (MA) model. The AR component models the relationship between the current and past values of the time series data. The I component models the data difference in order to satisfy the condition of stationarity. The MA models the remaining noise.

- Our next study will evaluate other statistical models such as TSMixer, DARTS (Detection of Anomalies in Time Series), Tsfresh, Ruptures, and LSTM.

Explore More

- Python Quant Trading Challenge: Can Dividend Stocks, NG and BTC Diversify Positively Correlated Big Tech Assets?

- Robust Anomaly Detection using the Isolation Forest Algorithm: Financial Transactions vs NYC Taxi Rides

- Time Series Forecasting of Hourly U.S.A. Energy Consumption – PJM East Electricity Grid

- Predicting the JPM Stock Price and Breakouts with Auto ARIMA, FFT, LSTM and Technical Trading Indicators

- SARIMAX X-Validation of EIA Crude Oil Prices Forecast in 2023 – 2. Brent

- Stock Forecasting with FBProphet

One-Time

Monthly

Yearly

Make a one-time donation

Make a monthly donation

Make a yearly donation

Choose an amount

€5.00

€15.00

€100.00

€5.00

€15.00

€100.00

€5.00

€15.00

€100.00

Or enter a custom amount

€

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearly

Leave a comment