- Blue chip stocks are the stocks of well-known, high-quality companies that are industry leaders.

- The blue chip stocks’ attractive risk-reward profiles make them among the most popular for conservative investors. But even more risk-tolerant investors should consider buying blue chip stocks to diversify their portfolios better and provide stability during turbulent stock market conditions.

- In portfolio management, we are interested in getting high returns while simultaneously reducing risks; however, the stocks that have the potential of bringing high returns typically carry high risk of losing money.

- Portfolio optimization balances risk and return by combining risky and safe investments in a ratio that matches the investor’s risk tolerance.

- Failure to consider multiple attributes and criteria for portfolio evaluation is one of the most significant drawbacks of conventional technical analysis models.

- In this post, we will overcome these drawbacks by combining several robust trading indicators and risk management algorithms to facilitate the trading decision-making.

- The current focus is on the art of forecasting price movements through the study of chart patterns, trading signals, risk metrics, etc.

- Our ultimate goal is to demonstrate that the proposed integrated approach can help optimize the blue-chip portfolios comprehensively and support traders to execute their trading strategies effectively.

Table of Contents

- AMZN Moving Averages

- AMZN Market Direction

- AMZN Feature Importance

- AAPL Market Capture Ratios

- TSLA Bollinger Bands

- TSLA RSI Trading Signals

- TSLA MACD Signal Line

- Portfolio Returns

- Stock Correlations

- Standard Deviations

- EWA

- $$$ ROI

- Sharpe Ratio

- Evaluation

- Summary

- Explore More

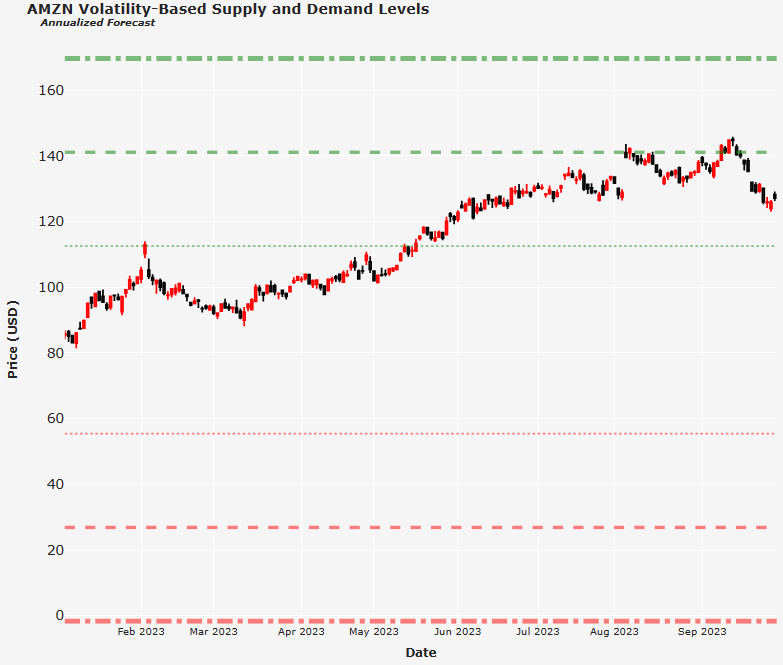

- Appendix: Supply-Demand Levels

AMZN Moving Averages

We begin with moving averages (MA) that help to filter out the noise and act as trend-following indicators. When the price level of a stock rises above MA, traders consider it as an indication to buy. And when the price falls below MA, traders assume it as a signal to sell.

Let’s set the working directory PATH

import os

os.chdir('PATH') # Set working directory

os. getcwd()

and download the AMZN stock data using yfinance

import yfinance as yf

import pandas as pd

ticker = 'AMZN'

start_date = '2007-01-01'

end_date = '2023-09-29'

stock_data = yf.download(ticker, start=start_date, end=end_date)

Let’s compute and plot MA 5-20-50-200

stock_data['MovingAverage_5'] = stock_data['Adj Close'].rolling(window=5).mean()

stock_data['MovingAverage_20'] = stock_data['Adj Close'].rolling(window=20).mean()

stock_data['MovingAverage_50'] = stock_data['Adj Close'].rolling(window=50).mean()

stock_data['MovingAverage_200'] = stock_data['Adj Close'].rolling(window=200).mean()

stock_data.dropna(inplace=True)

import numpy as np

import pandas as pd

from math import sqrt

import matplotlib.pyplot as plt

symbol=ticker

#series = stock_data['Adj Close']

#series.index = np.arange(series.shape[0])

plt.figure(figsize=(16, 10))

plt.rcParams.update({'font.size': 22})

plt.title(symbol)

plt.xlabel('Days')

plt.ylabel('Prices')

#plt.plot(stock_data['Adj Close'], label=symbol)

pts=stock_data['MovingAverage_5']

plt.plot(pts, label=f'MA5 {symbol}')

pts=stock_data['MovingAverage_20']

plt.plot(pts, label=f'MA20 {symbol}')

pts=stock_data['MovingAverage_50']

plt.plot(pts, label=f'MA50 {symbol}')

pts=stock_data['MovingAverage_200']

plt.plot(pts, label=f'MA200 {symbol}')

plt.legend()

plt.grid()

AMZN Market Direction

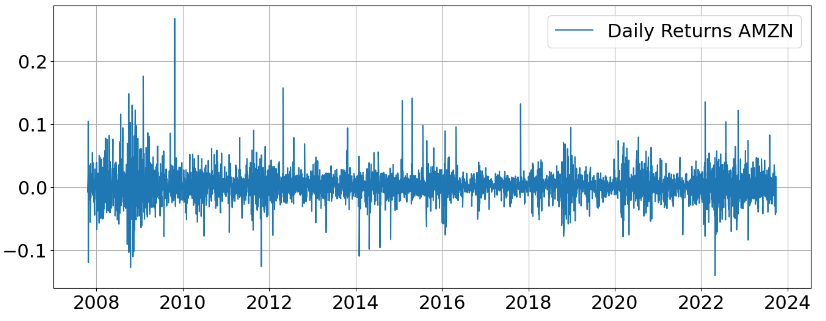

Let’s compute the AMZN Daily Returns and Market Direction

def create_labels(data, threshold=0.0):

data['MarketDirection'] = 0

data.loc[data['DailyReturns'] <= -threshold, 'MarketDirection'] = 1

stock_data['DailyReturns'] = stock_data['Adj Close'].pct_change()

create_labels(stock_data, threshold=0.02)

The Daily Returns AMZN plot is given by

plt.figure(figsize=(16, 6))

pts=stock_data['DailyReturns']

plt.plot(pts, label=f'Daily Returns {symbol}')

plt.legend()

plt.grid()

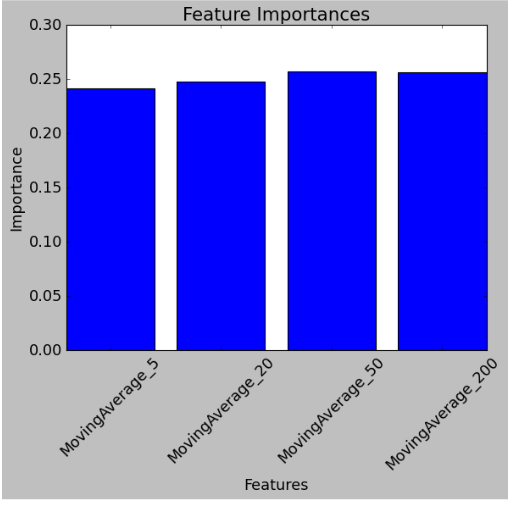

AMZN Feature Importance

Let’s implement the Random Forest Binary Classifier of Market Direction

from sklearn.ensemble import RandomForestClassifier

from sklearn.model_selection import train_test_split

X = stock_data[['MovingAverage_5', 'MovingAverage_20', 'MovingAverage_50', 'MovingAverage_200']]

y = stock_data['MarketDirection']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

model = RandomForestClassifier(n_estimators=100, random_state=42)

model.fit(X_train, y_train)

from sklearn.metrics import accuracy_score, classification_report

import matplotlib.pyplot as plt

y_pred = model.predict(X_test)

accuracy = accuracy_score(y_test, y_pred)

print(f"Model Accuracy: {accuracy:.2f}")

classification_report_str = classification_report(y_test, y_pred)

print("Classification Report:")

print(classification_report_str)

feature_importances = model.feature_importances_

features = X.columns

plt.figure(figsize=(8, 6))

plt.bar(features, feature_importances)

plt.title('Feature Importances')

plt.xlabel('Features')

plt.ylabel('Importance')

plt.xticks(rotation=45)

plt.show()

Model Accuracy: 0.84

Classification Report:

precision recall f1-score support

0 0.88 0.94 0.91 706

1 0.19 0.09 0.12 97

accuracy 0.84 803

macro avg 0.54 0.52 0.52 803

weighted avg 0.80 0.84 0.82 803

AAPL Market Capture Ratios

One popular tool used to assess a strategy’s behavior versus a benchmark is the market capture ratio, which helps us assess an investment’s ability to capture both upside and downside movements in the market.

Let’s import the basic libraries

import pandas as pd

import numpy as np

import yfinance as yf

and introduce the following market_capture_ratio function

# %% Function

def market_capture_ratio(returns):

"""

Function to calculate the upside and downside capture for a given set of returns.

The function is set up so that the investment's returns are in the first column of the dataframe

and the index returns are the second column.

:param returns: pd.DataFrame of asset class returns

:return: pd.DataFrame of market capture results

"""

# initialize an empty dataframe to store the results

df_mkt_capture = pd.DataFrame()

# 1) Upside capture ratio

# a) Isolate positive periods of the index

up_market = returns[returns.iloc[:, -1] >= 0]

# b) Geometrically link the returns

up_linked_rets = ((1 + up_market).product(axis=0)) - 1

# c) Calculate the ratio, multiply by 100 and round to 2 decimals to show in percent

up_ratio = (up_linked_rets / up_linked_rets.iloc[-1] * 100).round(2)

# 2) Downside capture ratio

# a) Isolate negative periods of the index

down_market = returns[returns.iloc[:, -1] < 0]

# b) Geometrically link the returns

down_linked_rets = ((1 + down_market).product(axis=0)) - 1

# c) Calculate the ratio, multiply by 100 and round to 2 decimals to show in percent

down_ratio = (down_linked_rets / down_linked_rets.iloc[-1] * 100).round(2)

# 3) Combine to produce our final dataframe

df_mkt_capture = pd.concat([up_ratio, down_ratio], axis=1)

df_mkt_capture.columns = ['Upside Capture', 'Downside Capture']

return df_mkt_capture

Let’s calculate the upside/downside capture ratios of AAPL vs SPY

# %% Retrieve the returns

# Specify the tickers to retrieve using yfinance

tickers = ['AAPL', 'SPY']

start_date = '2018-01-01'

end_date = '2023-09-29'

# Retrieve the historical data for the tickers

df_prices = yf.download(tickers, start=start_date, end=end_date)

# Keep only the adjusted close columns

df_prices = df_prices['Adj Close']

# Resample to month end and calculate the monthly percent change

df_rets_monthly = df_prices.resample('M').last().pct_change().dropna()

# Calculate the market capture ratios

df_mkt_capture = market_capture_ratio(df_rets_monthly)

print(df_mkt_capture)

Upside Capture Downside Capture

AAPL 306.46 101.94

SPY 100.00 100.00

- The upside capture ratio of 306% means that the strategy would capture 306% of the positive performance of the benchmark or outperformed during the period. In other words, if the benchmark experienced the 10% gain, our investment would have produced the 30% gain.

- The downside capture ratio of 102% means that our investment underperformed the benchmark during down periods.

- A strategy with ratios of over 100% would normally be indicative of strategies that are more aggressive than the underlying benchmark while ratios under 100% would be indicative of more conservative strategies.

- Ideally, the goal is to create strategies that have upside capture ratios over 100% and downside ratios under 100%.

- Read more here.

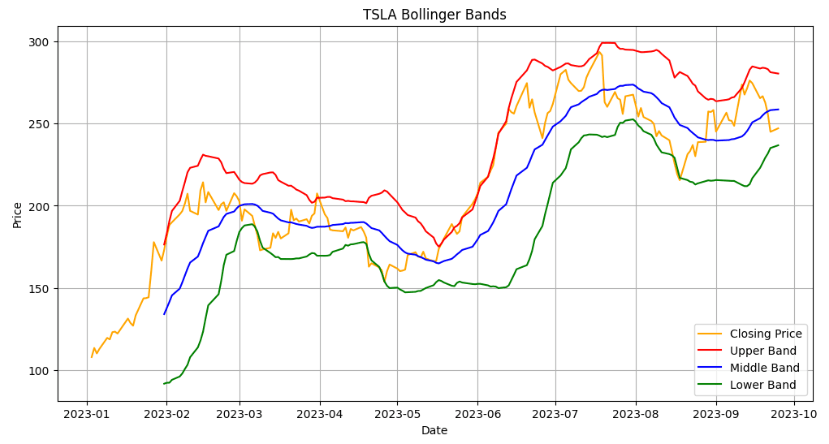

TSLA Bollinger Bands

- Bollinger Bands, a technical indicator developed by John Bollinger, are used to measure a market’s volatility and identify “overbought” or “oversold” conditions.

- Consider the TSLA example of using Bollinger Bands (BB) to compute trading signals

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

def generate_bollinger_bands(data):

data['Middle_Band'] = data['Close'].rolling(window=20).mean()

data['Upper_Band'] = data['Middle_Band'] + 2 * data['Close'].rolling(window=20).std()

data['Lower_Band'] = data['Middle_Band'] - 2 * data['Close'].rolling(window=20).std()

return data

if __name__ == "__main__":

ticker_symbol = 'TSLA' # Ticker symbol for Tesla Inc.

start_date = '2023-01-01' # Replace with the desired start date

end_date = '2023-09-26' # Replace with the desired end date

# Fetch historical price data from Yahoo Finance

data = yf.download(ticker_symbol, start=start_date, end=end_date)

# Generate Bollinger Bands

data = generate_bollinger_bands(data)

# Plot Bollinger Bands and Closing Price

plt.figure(figsize=(12, 6))

plt.plot(data.index, data['Close'], label='Closing Price', color='orange')

plt.plot(data.index, data['Upper_Band'], label='Upper Band', color='red')

plt.plot(data.index, data['Middle_Band'], label='Middle Band', color='blue')

plt.plot(data.index, data['Lower_Band'], label='Lower Band', color='green')

plt.title(f'{ticker_symbol} Bollinger Bands')

plt.xlabel('Date')

plt.ylabel('Price')

plt.legend(loc='lower right')

plt.grid()

plt.show()

The most basic interpretation of BB is that the channels represent a measure of ‘highness’ and ‘lowness’:

- The upper band shows a level that is statistically high or expensive

- The lower band shows a level that is statistically low or cheap

- The BB width is linked to the stock volatility

- In a more volatile case, BB widen

- In a less volatile case, the bands narrow

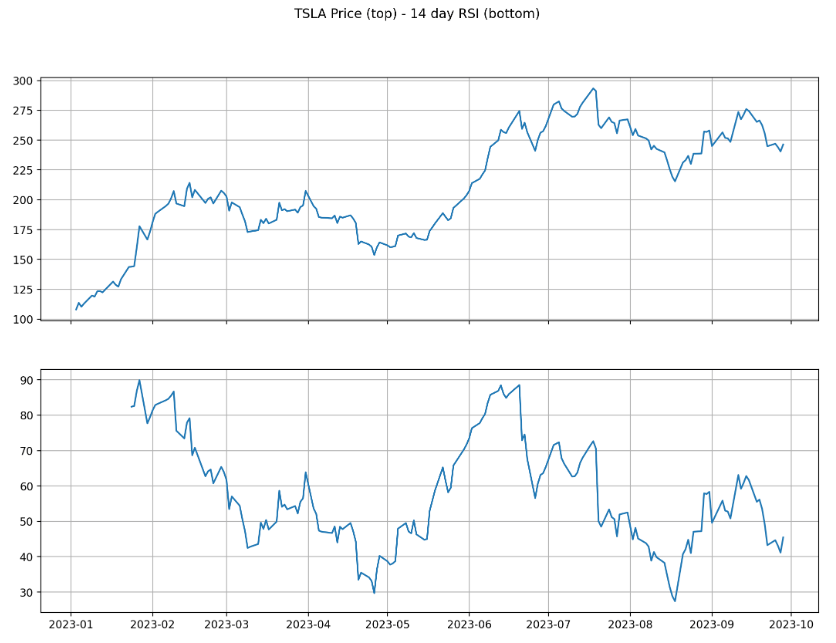

TSLA RSI Trading Signals

- Momentum indicators are technical analysis tools used to determine the strength or weakness of a stock’s price. Momentum measures the rate of the rise or fall of stock prices. Common momentum indicators include the relative strength index (RSI) and moving average convergence divergence (MACD).

- Let’s invoke momentum trading indicators such as MACD and RSI to compute TSLA trading signals

import pandas as pd

import numpy as np

import datetime as dt

import matplotlib.pyplot as plt

from pandas_datareader import data as pdr

import yfinance as yf

yf.pdr_override()

# YFinance API Pull

ticker = 'TSLA'

now = dt.datetime.now()

startyear = 2023

startmonth = 1

startday = 2

start = dt.datetime(startyear, startmonth, startday)

df = pdr.get_data_yahoo(ticker, start = "2023-01-01", end = "2023-09-29")

df.tail()

# 14_Day RSI

df['Up Move'] = np.nan

df['Down Move'] = np.nan

df['Average Up'] = np.nan

df['Average Down'] = np.nan

# Relative Strength

df['RS'] = np.nan

# Relative Strength Index

df['RSI'] = np.nan

#Calculate Up Move & Down Move

for x in range(1, len(df)):

df['Up Move'][x] = 0

df['Down Move'][x] = 0

if df['Adj Close'][x] > df['Adj Close'][x-1]:

df['Up Move'][x] = df['Adj Close'][x] - df['Adj Close'][x-1]

if df['Adj Close'][x] < df['Adj Close'][x-1]:

df['Down Move'][x] = abs(df['Adj Close'][x] - df['Adj Close'][x-1])

#Calculate initial Average Up & Down, RS and RSI

df['Average Up'][14] = df['Up Move'][1:15].mean()

df['Average Down'][14] = df['Down Move'][1:15].mean()

df['RS'][14] = df['Average Up'][14] / df['Average Down'][14]

df['RSI'][14] = 100 - (100/(1+df['RS'][14]))

#Calculate rest of Average Up, Average Down, RS, RSI

for x in range(15, len(df)):

df['Average Up'][x] = (df['Average Up'][x-1]*13+df['Up Move'][x])/14

df['Average Down'][x] = (df['Average Down'][x-1]*13+df['Down Move'][x])/14

df['RS'][x] = df['Average Up'][x] / df['Average Down'][x]

df['RSI'][x] = 100 - (100/(1+df['RS'][x]))

print(df)

Open High Low Close Adj Close \

Date

2023-01-03 118.470001 118.800003 104.639999 108.099998 108.099998

2023-01-04 109.110001 114.589996 107.519997 113.639999 113.639999

2023-01-05 110.510002 111.750000 107.160004 110.339996 110.339996

2023-01-06 103.000000 114.389999 101.809998 113.059998 113.059998

2023-01-09 118.959999 123.519997 117.110001 119.769997 119.769997

... ... ... ... ... ...

2023-09-22 257.399994 257.790009 244.479996 244.880005 244.880005

2023-09-25 243.380005 247.100006 238.309998 246.990005 246.990005

2023-09-26 242.979996 249.550003 241.660004 244.119995 244.119995

2023-09-27 244.259995 245.330002 234.580002 240.500000 240.500000

2023-09-28 240.020004 247.550003 238.649994 246.380005 246.380005

Volume Up Move Down Move Average Up Average Down \

Date

2023-01-03 231402800 NaN NaN NaN NaN

2023-01-04 180389000 5.540001 0.000000 NaN NaN

2023-01-05 157986300 0.000000 3.300003 NaN NaN

2023-01-06 220911100 2.720001 0.000000 NaN NaN

2023-01-09 190284000 6.709999 0.000000 NaN NaN

... ... ... ... ... ...

2023-09-22 127024300 0.000000 10.819992 2.771808 3.635013

2023-09-25 104636600 2.110001 0.000000 2.724536 3.375369

2023-09-26 101993600 0.000000 2.870010 2.529926 3.339272

2023-09-27 136597200 0.000000 3.619995 2.349217 3.359323

2023-09-28 116811300 5.880005 0.000000 2.601416 3.119372

RS RSI

Date

2023-01-03 NaN NaN

2023-01-04 NaN NaN

2023-01-05 NaN NaN

2023-01-06 NaN NaN

2023-01-09 NaN NaN

... ... ...

2023-09-22 0.762530 43.263389

2023-09-25 0.807182 44.665218

2023-09-26 0.757628 43.105140

2023-09-27 0.699313 41.152672

2023-09-28 0.833955 45.473039

[186 rows x 12 columns]

## Chart the stock price and RSI

fig, axs = plt.subplots(2, sharex=True, figsize=(13,9))

fig.suptitle('TSLA Price (top) - 14 day RSI (bottom)')

axs[0].plot(df['Adj Close'])

axs[1].plot(df['RSI'])

axs[0].grid()

axs[1].grid()

## Calculate the buy & sell signals

## Initialize columns

df['Long Tomorrow'] = np.nan

df['Buy Signal'] = np.nan

df['Sell Signal'] = np.nan

df['Buy RSI'] = np.nan

df['Sell RSI'] = np.nan

df['Strategy'] = np.nan

#Calculate the buy & sell signals

for x in range(15, len(df)):

#calculate "Long Tomorrow" column

if ((df['RSI'][x] <= 40) & (df['RSI'][x-1]>40) ):

df['Long Tomorrow'][x] = True

elif ((df['Long Tomorrow'][x-1] == True) & (df['RSI'][x] <= 70)):

df['Long Tomorrow'][x] = True

else:

df['Long Tomorrow'][x] = False

#calculate "Buy Signal" column

if ((df['Long Tomorrow'][x] == True) & (df['Long Tomorrow'][x-1] == False)):

df['Buy Signal'][x] = df['Adj Close'][x]

df['Buy RSI'][x] = df['RSI'][x]

#calculate "Sell Signal" column

if ((df['Long Tomorrow'][x] == False) & (df['Long Tomorrow'][x-1] == True)):

df['Sell Signal'][x] = df['Adj Close'][x]

df['Sell RSI'][x] = df['RSI'][x]

#calculate strategy performance

df['Strategy'][15] = df['Adj Close'][15]

for x in range(16, len(df)):

if df['Long Tomorrow'][x-1] == True:

df['Strategy'][x] = df['Strategy'][x-1]* (df['Adj Close'][x] / df['Adj Close'][x-1])

else:

df['Strategy'][x] = df['Strategy'][x-1]

## Chart the buy/sell signals

#plt.style.use('_classic_test')

fig, axs = plt.subplots(2, sharex=True, figsize=(13,9))

fig.suptitle('Stock Price (top) & 14 day RSI (bottom)')

## Chart the stock close price & buy/sell signals

axs[0].scatter(df.index, df['Buy Signal'], color = 'green', marker = '^', alpha = 1)

axs[0].scatter(df.index, df['Sell Signal'], color = 'red', marker = 'v', alpha = 1)

axs[0].plot(df['Adj Close'], alpha = 0.8)

axs[0].grid()

## Chart RSI & buy/sell signals

axs[1].scatter(df.index, df['Buy RSI'], color = 'green', marker = '^', alpha = 1)

axs[1].scatter(df.index, df['Sell RSI'], color = 'red', marker = 'v', alpha = 1)

axs[1].plot(df['RSI'], alpha = 0.8)

axs[1].grid()

Low RSI levels, below 40, generate buy signals and indicate an oversold or undervalued condition. High RSI levels, above 70, generate sell signals and suggest that a security is overbought or overvalued.

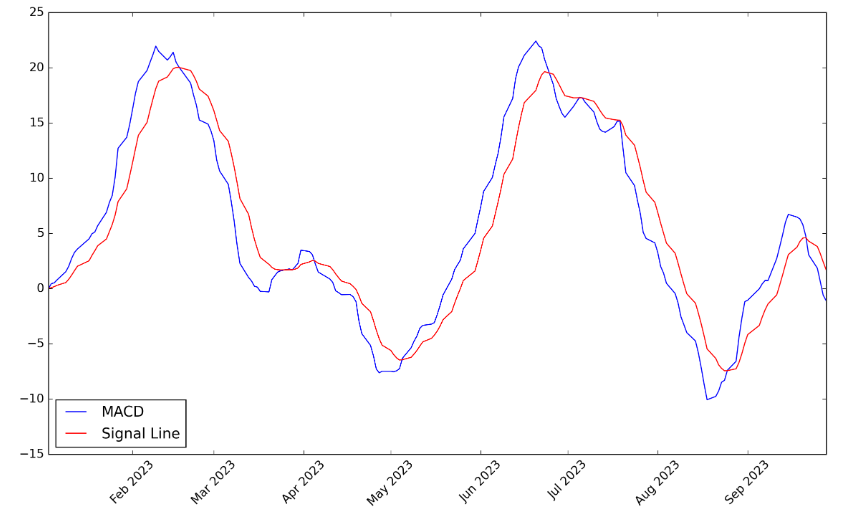

TSLA MACD Signal Line

## Calculate the MACD and Signal Line indicators

## Calculate the Short Term Exponential Moving Average

ShortEMA = df.Close.ewm(span=12, adjust=False).mean()

## Calculate the Long Term Exponential Moving Average

LongEMA = df.Close.ewm(span=26, adjust=False).mean()

## Calculate the Moving Average Convergence/Divergence (MACD)

MACD = ShortEMA - LongEMA

## Calculate the signal line

signal = MACD.ewm(span=9, adjust=False).mean()

#Plot the chart

plt.figure(figsize=(14,8))

plt.style.use('classic')

plt.plot(df.index, MACD, label='MACD', color = 'blue')

plt.plot(df.index, signal, label='Signal Line', color='red')

plt.xticks(rotation=45)

plt.legend(loc='lower left')

plt.show()

In the above plot, signal line crossovers are the most common MACD signals. A bullish crossover occurs when the MACD turns up and crosses above the signal line. A bearish crossover occurs when the MACD turns down and crosses below the signal line. Crossovers can last a few days or a few weeks, depending on the strength of the move.

Portfolio Returns

Let’s create and optimize the blue-chip portfolio using the trading dashboard.

- Input data

# Import libraries and dependencies

import numpy as np

import pandas as pd

import yfinance as yf

## AAPL DATA

cmg = yf.Ticker("AAPL")

cmg_historical = cmg.history(start="2023-1-1", end="2023-9-29", interval="1d")

cmg_df = cmg_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

cmg_df.rename(columns= {'Close':'AAPL'}, inplace=True)

cmg_daily = cmg_df.pct_change()

## JPM DATA

shop = yf.Ticker("JPM")

shop_historical = shop.history(start="2023-1-1", end="2023-9-29", interval="1d")

shop_df = shop_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

shop_df.rename(columns= {'Close':'JPM'}, inplace=True)

shop_daily = shop_df.pct_change()

## TSLA DATA

tsla= yf.Ticker("TSLA")

tsla_historical = tsla.history(start="2023-1-1", end="2023-9-26", interval="1d")

tsla_df = tsla_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

tsla_df.rename(columns= {'Close':'TSLA'}, inplace=True)

tsla_daily = tsla_df.pct_change()

## PG DATA

panw = yf.Ticker("PG")

panw_historical = panw.history(start="2023-1-1", end="2023-9-29", interval="1d")

panw_df = panw_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

panw_df.rename(columns= {'Close':'PG'}, inplace=True)

panw_daily = panw_df.pct_change()

## AMAZON DATA

amzn = yf.Ticker("AMZN")

amzn_historical = amzn.history(start="2023-1-1", end="2023-9-29", interval="1d")

amzn_df = amzn_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

amzn_df.rename(columns= {'Close':'AMZN'}, inplace=True)

amzn_daily = amzn_df.pct_change()

## META DATA

fb = yf.Ticker("META")

fb_historical = fb.history(start="2023-1-1", end="2023-9-29", interval="1d")

fb_df = fb_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

fb_df.rename(columns= {'Close':'META'}, inplace=True)

fb_daily = fb_df.pct_change()

# Concatenate joining tickers into one DataFrame

portfolio_df = pd.concat([fb_daily, amzn_daily, tsla_daily, panw_daily, shop_daily, cmg_daily], axis="columns", join="inner")

daily_portfolio = portfolio_df

daily_portfolio.dropna()

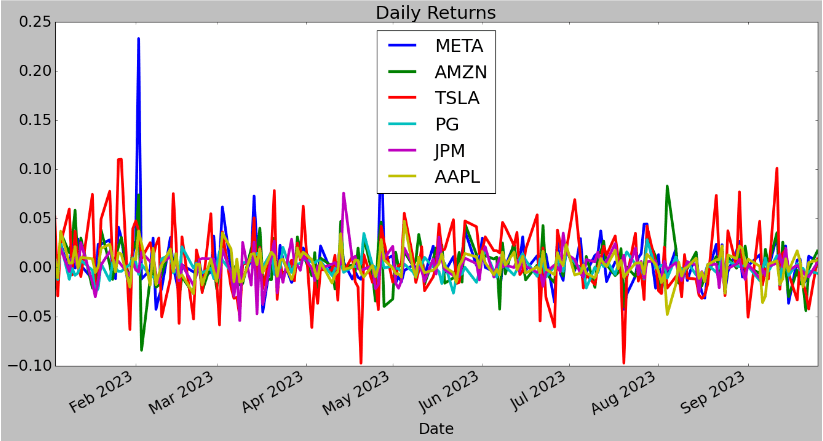

- Daily returns

plt.rcParams.update({'font.size': 22})

daily_portfolio.plot(figsize=(20, 10), title="Daily Returns",lw=4)

- Cumulative returns

cumulative_returns = (1 + daily_portfolio).cumprod()

cumulative_returns.plot(figsize=(20, 10), title="Cumulative Returns",lw=4)

The figure compares the cumulative returns of investing $1 in January 2023 until 2023-09-25 for our 6 stocks.

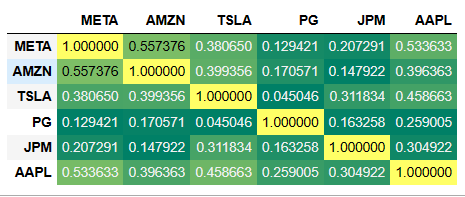

Stock Correlations

Correlation is closely tied to diversification, the concept that certain types of risk can be mitigated by investing in assets that are not correlated.

# Construct a correlation table

corr_df = daily_portfolio.corr()

corr_df.style.background_gradient(cmap="summer")

This matrix tells you how strongly each asset in a portfolio is related to the others.

Standard Deviations

Standard deviation (STD) is the most common way to measure market volatility, and traders can use BB to analyze STD. In most cases, when the price of an asset is trending upwards, the standard deviation is usually relatively low.

# Daily Standard Deviations

# Calculate the standard deviation for each portfolio.

daily_portfolio.std()

META 0.027521

AMZN 0.021600

TSLA 0.034879

PG 0.009199

JPM 0.014168

AAPL 0.013388

dtype: float64

# Calculate the annualized standard deviation (252 trading days)

daily_portfolio.std() * np.sqrt(252)

META 0.436883

AMZN 0.342885

TSLA 0.553688

PG 0.146036

JPM 0.224904

AAPL 0.212530

dtype: float64

# Calculate and plot the rolling standard deviation for

# the blue-chip portfolio using a 21 trading day window

daily_portfolio.rolling(window=21).std().plot(figsize=(20, 10), title="21 Day Rolling Standard Deviation",lw=4)

EWA

An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period. This is a technical chart indicator that tracks the price of an investment (like a stock or commodity) over time.

# Calculate a rolling window using the exponentially weighted moving average.

daily_portfolio.ewm(halflife=21).std().plot(figsize=(20, 10), title="Exponentially Weighted Average",lw=4)

$$$ ROI

# Plot returns of the portfolio in terms of money

initial_investment = 10000

cumulative_profit = initial_investment * cumulative_returns

cumulative_profit.plot(figsize=(20, 10),lw=4)

The above plot provides a glimpse of the investment’s prior performance and helps determine if a particular investment has been profitable in 2023.

Sharpe Ratio

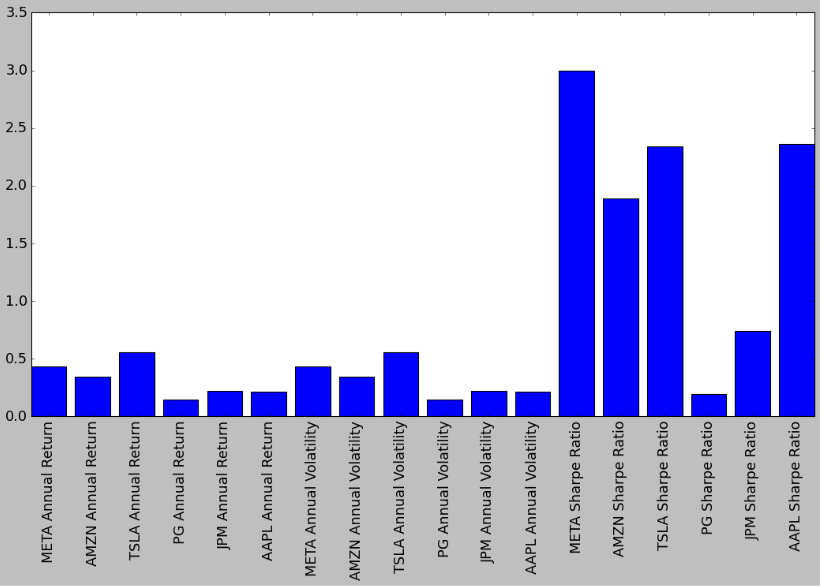

The Sharpe ratio compares the return of an investment with its risk. A higher Sharpe ratio is better when comparing similar portfolios. Usually, any Sharpe ratio greater than 1.0 is considered acceptable to good by investors. A ratio higher than 2.0 is rated as very good. A ratio of 3.0 or higher is considered excellent. A ratio under 1.0 is considered sub-optimal.

# Calculate annualized Sharpe Ratios

sharpe_ratios = (daily_portfolio.mean() * 252) / (daily_portfolio.std() * np.sqrt(252))

sharpe_ratios

META 3.000124

AMZN 1.888006

TSLA 2.343991

PG 0.193469

JPM 0.743038

AAPL 2.363905

dtype: float64

# Visualize the sharpe ratios as a bar plot

sharpe_ratios.plot(figsize=(15, 8),kind="bar", title="Sharpe Ratios", color= 'orange')

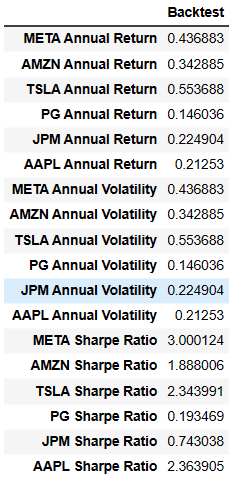

Evaluation

# Prepare DataFrame for metrics

metrics = [

'META Annual Return', 'AMZN Annual Return', 'TSLA Annual Return','PG Annual Return','JPM Annual Return', 'AAPL Annual Return',

'META Annual Volatility','AMZN Annual Volatility','TSLA Annual Volatility','PG Annual Volatility','JPM Annual Volatility','AAPL Annual Volatility',

'META Sharpe Ratio','AMZN Sharpe Ratio','TSLA Sharpe Ratio','PG Sharpe Ratio','JPM Sharpe Ratio','AAPL Sharpe Ratio']

columns = ['Backtest']

# Initialize the DataFrame with index set to evaluation metrics and column as `Backtest` (just like PyFolio)

portfolio_evaluation_df = pd.DataFrame(index=metrics, columns=columns)

# Calculate annualized return

portfolio_evaluation_df.loc['META Annual Return'] = daily_portfolio['META'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['AMZN Annual Return'] = daily_portfolio['AMZN'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['TSLA Annual Return'] = daily_portfolio['TSLA'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['PG Annual Return'] = daily_portfolio['PG'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['JPM Annual Return'] = daily_portfolio['JPM'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['AAPL Annual Return'] = daily_portfolio['AAPL'].std() * np.sqrt(252)

# Calculate annual volatility

portfolio_evaluation_df.loc['META Annual Volatility'] = daily_portfolio['META'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['AMZN Annual Volatility'] = daily_portfolio['AMZN'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['TSLA Annual Volatility'] = daily_portfolio['TSLA'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['PG Annual Volatility'] = daily_portfolio['PG'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['JPM Annual Volatility'] = daily_portfolio['JPM'].std() * np.sqrt(252)

portfolio_evaluation_df.loc['AAPL Annual Volatility'] = daily_portfolio['AAPL'].std() * np.sqrt(252)

# Calculate Sharpe Ratio

portfolio_evaluation_df.loc['META Sharpe Ratio'] = sharpe_ratios['META']

portfolio_evaluation_df.loc['AMZN Sharpe Ratio'] = sharpe_ratios['AMZN']

portfolio_evaluation_df.loc['TSLA Sharpe Ratio'] = sharpe_ratios['TSLA']

portfolio_evaluation_df.loc['PG Sharpe Ratio'] = sharpe_ratios['PG']

portfolio_evaluation_df.loc['JPM Sharpe Ratio'] = sharpe_ratios['JPM']

portfolio_evaluation_df.loc['AAPL Sharpe Ratio'] = sharpe_ratios['AAPL']

portfolio_evaluation_df.head(18)

print (portfolio_evaluation_df)

index Backtest

0 META Annual Return 0.436883

1 AMZN Annual Return 0.342885

2 TSLA Annual Return 0.553688

3 PG Annual Return 0.146036

4 JPM Annual Return 0.224904

5 AAPL Annual Return 0.21253

6 META Annual Volatility 0.436883

7 AMZN Annual Volatility 0.342885

8 TSLA Annual Volatility 0.553688

9 PG Annual Volatility 0.146036

10 JPM Annual Volatility 0.224904

11 AAPL Annual Volatility 0.21253

12 META Sharpe Ratio 3.000124

13 AMZN Sharpe Ratio 1.888006

14 TSLA Sharpe Ratio 2.343991

15 PG Sharpe Ratio 0.193469

16 JPM Sharpe Ratio 0.743038

17 AAPL Sharpe Ratio 2.363905

plt.figure(figsize=(16,8))

plt.rcParams.update({'font.size': 16})

plt.bar(portfolio_evaluation_df['index'],portfolio_evaluation_df['Backtest'])

plt.xticks(rotation=90)

This plot shows the following:

- max/min Return = TSLA/PG

- max/min Volatility = TSLA/PG

- max/min Sharpe Ratio = META/PG

Summary

- In this post, we have tested the integrated multi-attribute technical analysis to optimize blue-chip stock portfolios.

- We have investigated trend reversals of top blue chips (META, AMZN, TSLA, PG, JPM, and AAPL) by comparing various trading indicators (MA, EWA, MACD, RSI, and BB) and stock returns vs volatility measures.

- We have chosen the optimal set of MA using the Random Forest dominance factors.

- As an example, we have assessed the AAPL strategy behavior versus SPY using the market capture ratio.

- We have examined the portfolio correlation matrix closely tied to diversification.

- We have assessed the risk-adjusted performance of our portfolio in terms of the Sharpe ratio.

- In Appendix, we have also examine the support and resistance levels of our portfolio based upon the law of supply and demand.

- Our final stock evaluation metrics are Annual Return, Annual Volatility, and Annual Sharpe Ratio.

Explore More

- Blue-Chip Stock Portfolios for Quant Traders

- Are Blue-Chips Perfect for This Bear Market?

- Inflation-Resistant Stocks to Buy

- Quant Trading using Monte Carlo Predictions and 62 AI-Assisted Trading Technical Indicators (TTI)

- Algorithmic Testing Stock Portfolios to Optimize the Risk/Reward Ratio

- Stock Portfolio Risk/Return Optimization

- Towards Max(ROI/Risk) Trading

- Portfolio max(Return/Risk) Stochastic Optimization of 20 Dividend Growth Stocks

- Risk-Aware Strategies for DCA Investors

Appendix: Supply-Demand Levels

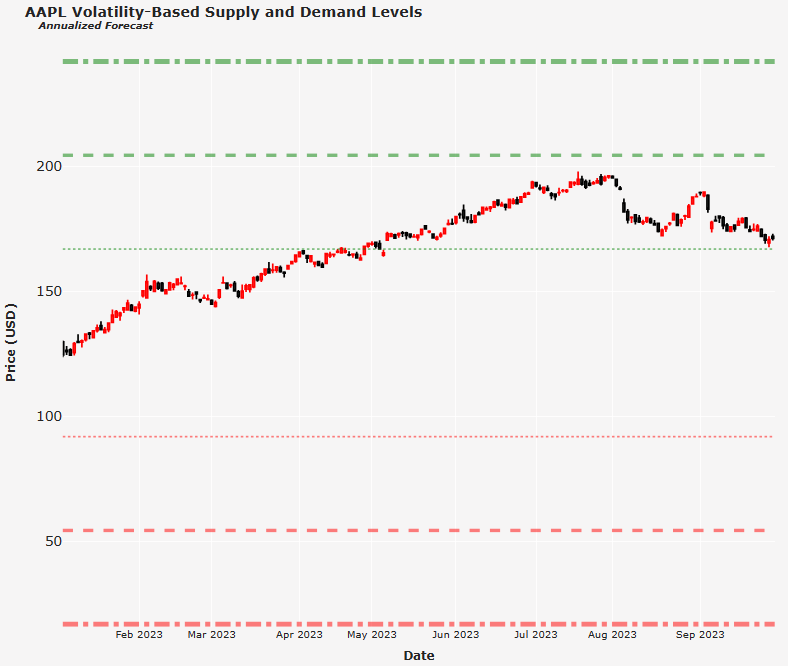

- The common technical analysis is focused on past price actions, usually using candlestick charts, to identify levels where a trend reversal occurred.

- Instead, we will examine the support and resistance levels of our portfolio based upon the law of supply and demand. Following recent studies, we proposes using volatility for forecasting supply and demand zones in a form that isn’t subjective to personal interpretation of a price chart.

- Importing key libraries

# Importing Libraries

# Data Handling

import pandas as pd

import numpy as np

# Financial Data Analysis

import yfinance as yf

# Data Visualization

import plotly.express as px

import plotly.graph_objs as go

import plotly.subplots as sp

from plotly.subplots import make_subplots

import plotly.figure_factory as ff

import plotly.io as pio

from IPython.display import display

from plotly.offline import init_notebook_mode

# Statistics & Mathematics

import scipy.stats as stats

import statsmodels as sm

from scipy.stats import shapiro, skew

import math

# Hiding warnings

import warnings

warnings.filterwarnings("ignore")

- Handling input data

def load_and_preprocess(ticker):

'''

This function takes in a ticker symbol, which is used to

retrieve historical data from Yahoo Finance.

The attributes 'Returns', and the Adjusted Low, High, and Open

are created.

NaNs are filled with 0s

'''

df = yf.download(ticker)

df['Returns'] = df['Adj Close'].pct_change(1)

df['Adj Low'] = df['Low'] - (df['Close'] - df['Adj Close'])

df['Adj High'] = df['High'] - (df['Close'] - df['Adj Close'])

df['Adj Open'] = df['Open'] - (df['Close'] - df['Adj Close'])

df = df.fillna(0)

return df

- Selecting AAPL as an example

ticker = 'AAPL'

df = load_and_preprocess(ticker) # Loading and Transforming Dataframe

df.tail()

T = 20 # Time period for computing the standard deviation

df['Annualized_Vol'] = np.round(df['Returns'].rolling(T).std() * np.sqrt(252), 2)

# Creating a line plot to visualize historical volatility

lineplot = go.Scatter(

x=df.index,

y=df['Annualized_Vol'] * 100, # Annualized Volatility in %

mode='lines',

line=dict(color='darkblue', width=2.5),

name = 'Annualized Volatility (%)')

layout = go.Layout(

title={'text': f'<b>Annualized Volatility for {ticker} <br><i><sub></sub></i></b>',

'x': 0.035, 'xanchor': 'left'},

yaxis = dict(title = '<b>Annualized Volatility (%) </b>'),

xaxis = dict(title = '<b>Date</b>'),

template='seaborn',

height = 450, width = 1000,

showlegend=True,

plot_bgcolor = '#F6F5F5',

paper_bgcolor = '#F6F5F5',

xaxis_rangeslider_visible=False)

fig = go.Figure(data=[lineplot], layout=layout)

fig.show()

It is possible to detect in the plot above periods of high volatility where the stock experienced its highest points of fluctuation.

# Yearly forecasting

reference_year = "2022" # Forecasting levels for 2023

High_Band_1std = df.loc[reference_year]["Annualized_Vol"][-1]*df.loc[reference_year]["Adj Close"][-1] + df.loc[reference_year]["Adj Close"][-1]

Low_Band_1std = df.loc[reference_year]["Adj Close"][-1] - df.loc[reference_year]["Annualized_Vol"][-1]*df.loc[reference_year]["Adj Close"][-1]

High_Band_2std = 2*df.loc[reference_year]["Annualized_Vol"][-1]*df.loc[reference_year]["Adj Close"][-1] + df.loc[reference_year]["Adj Close"][-1]

Low_Band_2std = df.loc[reference_year]["Adj Close"][-1] - 2*df.loc[reference_year]["Annualized_Vol"][-1]*df.loc[reference_year]["Adj Close"][-1]

High_Band_3std = 3*df.loc[reference_year]["Annualized_Vol"][-1]*df.loc[reference_year]["Adj Close"][-1] + df.loc[reference_year]["Adj Close"][-1]

Low_Band_3std = df.loc[reference_year]["Adj Close"][-1] - 3*df.loc[reference_year]["Annualized_Vol"][-1]*df.loc[reference_year]["Adj Close"][-1]

rint(f'\nVolatility-Based Supply and Demand Levels for {ticker} in {int(reference_year) + 1}\n')

print(f'Supply Level 3σ: {High_Band_3std.round(2)}\n')

print(f'Supply Level 2σ: {High_Band_2std.round(2)}\n')

print(f'Supply Level 1σ: {High_Band_1std.round(2)}\n')

print('-' * 65, '\n')

print(f'Demand Level 1σ: {Low_Band_1std.round(2)}\n')

print(f'Demand Level 2σ: {Low_Band_2std.round(2)}\n')

print(f'Demand Level 3σ: {Low_Band_3std.round(2)}\n')

Volatility-Based Supply and Demand Levels for AAPL in 2023

Supply Level 3σ: 241.94

Supply Level 2σ: 204.42

Supply Level 1σ: 166.9

-----------------------------------------------------------------

Demand Level 1σ: 91.86

Demand Level 2σ: 54.34

Demand Level 3σ: 16.82

# Candlestick chart

candlestick = go.Candlestick(x = df.loc[str(int(reference_year) + 1)].index,

open = df.loc[str(int(reference_year) + 1)]['Adj Open'],

high = df.loc[str(int(reference_year) + 1)]['Adj High'],

low = df.loc[str(int(reference_year) + 1)]['Adj Low'],

close = df.loc[str(int(reference_year) + 1)]['Adj Close'],

increasing = dict(line=dict(color = 'red')),

decreasing = dict(line=dict(color = 'black')),

name = 'Candlesticks')

# Defining layout

layout = go.Layout(title = {'text': '<b>AAPL Volatility-Based Supply and Demand Levels<br><sup> <i>Annualized Forecast</i></sup></b>',

'x': .035, 'xanchor': 'left'},

yaxis = dict(title = '<b>Price (USD)</b>',

tickfont=dict(size=16)),

xaxis = dict(title = '<b>Date</b>'),

template = 'seaborn',

plot_bgcolor = '#F6F5F5',

paper_bgcolor = '#F6F5F5',

height = 850, width = 1000,

showlegend=False,

xaxis_rangeslider_visible = False)

# Defining figure

fig = go.Figure(data = [candlestick], layout = layout)

# Removing empty spaces (non-trading days)

dt_all = pd.date_range(start = df.index[0],

end = df.index[-1],

freq = "D")

dt_all_py = [d.to_pydatetime() for d in dt_all]

dt_obs_py = [d.to_pydatetime() for d in df.index]

dt_breaks = [d for d in dt_all_py if d not in dt_obs_py]

fig.update_xaxes(

rangebreaks = [dict(values = dt_breaks)]

)

# Adding Supply and Demans Lines

# 1σ

fig.add_hline(y = High_Band_1std, line_width = 2, line_dash = "dot", line_color = "green")

fig.add_hline(y = Low_Band_1std, line_width = 2, line_dash = "dot", line_color = "red")

# 2σ

fig.add_hline(y = High_Band_2std, line_width = 4, line_dash = "dash", line_color = "green")

fig.add_hline(y = Low_Band_2std, line_width = 4, line_dash = "dash", line_color = "red")

# 3σ

fig.add_hline(y = High_Band_3std, line_width = 6, line_dash = "dashdot", line_color = "green")

fig.add_hline(y = Low_Band_3std, line_width = 6, line_dash = "dashdot", line_color = "red")

# Showing plot

fig.show()

The output cell above gives us the specific supply and demand levels forecasted for the stock in 2023.

In the above plot, dot lines represent one standard deviation, 1σ (68.7% probability); dash lines represent two standard deviations, 2σ (95.4% probability); dash and dot lines represent three standard deviations, 3σ (99.7% probability).

Observe that the stock closed slightly higher than the 1σ supply band and below the 2σ supply band.

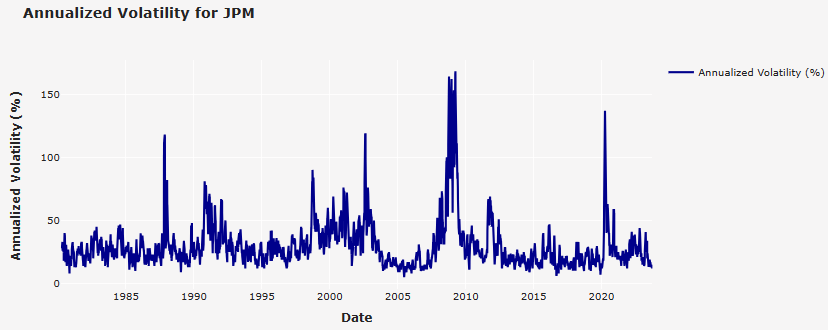

- JPM

ticker = 'JPM'

Volatility-Based Supply and Demand Levels for JPM in 2023

Supply Level 3σ: 202.02

Supply Level 2σ: 178.4

Supply Level 1σ: 154.79

-----------------------------------------------------------------

Demand Level 1σ: 107.57

Demand Level 2σ: 83.95

Demand Level 3σ: 60.34

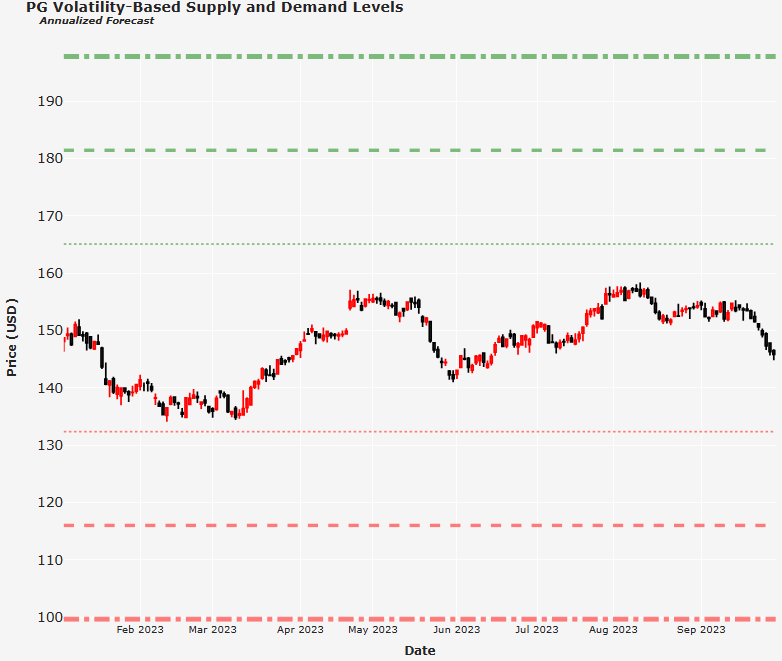

- PG

ticker = 'PG'

Volatility-Based Supply and Demand Levels for PG in 2023

Supply Level 3σ: 197.82

Supply Level 2σ: 181.46

Supply Level 1σ: 165.1

-----------------------------------------------------------------

Demand Level 1σ: 132.38

Demand Level 2σ: 116.02

Demand Level 3σ: 99.66

- TSLA

ticker = 'TSLA'

Volatility-Based Supply and Demand Levels for TSLA in 2023

Supply Level 3σ: 396.64

Supply Level 2σ: 305.49

Supply Level 1σ: 214.33

-----------------------------------------------------------------

Demand Level 1σ: 32.03

Demand Level 2σ: -59.13

Demand Level 3σ: -150.28

- AMZN

ticker = 'AMZN'

Volatility-Based Supply and Demand Levels for AMZN in 2023

Supply Level 3σ: 169.68

Supply Level 2σ: 141.12

Supply Level 1σ: 112.56

-----------------------------------------------------------------

Demand Level 1σ: 55.44

Demand Level 2σ: 26.88

Demand Level 3σ: -1.68

- META

ticker = 'META'

Volatility-Based Supply and Demand Levels for META in 2023

Supply Level 3σ: 286.41

Supply Level 2σ: 231.05

Supply Level 1σ: 175.7

-----------------------------------------------------------------

Demand Level 1σ: 64.98

Demand Level 2σ: 9.63

Demand Level 3σ: -45.73

Make a one-time donation

Make a monthly donation

Make a yearly donation

Choose an amount

Or enter a custom amount

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearly

Leave a comment