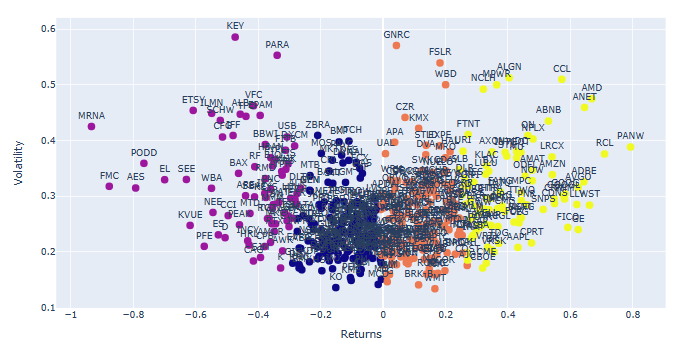

- The main objective of this study is to implement and evaluate the K-means algorithm for ranking/clustering of all S&P 500 stocks based on their average annualized return and average annualized volatility.

- The second goal is to detect anomalies in the best performing S&P 500 stock price 2023 by invoking the Isolation Forest algorithm.

- The third goal is to detect anomalies in the S&P 500 historical stock price time series data with the available LSTM autoencoders, cf. 1, 2, and 3.

- Prerequisites: Python 3.12.0, Jupyter notebook (e.g. within Anaconda IDE), Numpy, Pandas, yfinance, pylab, Matplotlib, Plotly, SciPy, and sklearn. For example, Project Jupyter’s tools are available for installation via the Python Package Index, viz.

pip install jupyterlab

pip install notebook

Table of Contents

- Import Libraries

- S&P 500 2023 Main Clusters

- META Price 2023 Anomaly Detection

- 3D Cluster Analysis of 3 Leading Tech Stocks in 2023

- LSTM Anomalies of S&P 500 Index Historical Prices – Round 1

- LSTM Anomalies of S&P 500 Index Historical Prices – Round 2

- Summary

- References

- Explore More

Import Libraries

Let’s set the working directory YOURPATH

import os

os.chdir('YOURPATH')

os. getcwd()

and import the aforementioned libraries

import numpy as np

import pandas as pd

import pandas_datareader as dr

import yfinance as yf

from pylab import plot,show

from matplotlib import pyplot as plt

import plotly.express as px

from numpy.random import rand

from scipy.cluster.vq import kmeans,vq

from math import sqrt

from sklearn.cluster import KMeans

from sklearn import preprocessing

S&P 500 2023 Main Clusters

- Download the entire S&P 500 stock dataset in 2023

# Define the url

sp500_url = 'https://en.wikipedia.org/wiki/List_of_S%26P_500_companies'

# Read in the url and scrape ticker data

data_table = pd.read_html(sp500_url)

tickers = data_table[0]['Symbol'].values.tolist()

tickers = [s.replace('\n', '') for s in tickers]

tickers = [s.replace('.', '-') for s in tickers]

tickers = [s.replace(' ', '') for s in tickers]

start_date = '2023-01-01'

end_date = '2023-10-24'

# Download prices

prices_list = []

for ticker in tickers:

try:

prices = yf.download(ticker, start=start_date, end=end_date)['Adj Close']

prices = pd.DataFrame(prices)

prices.columns = [ticker]

prices_list.append(prices)

except:

pass

prices_df = pd.concat(prices_list,axis=1)

- Stock data manipulations to calculate the annualized Returns and Volatility columns

prices_df.sort_index(inplace=True)

# Create an empity dataframe

returns = pd.DataFrame()

# Define the column Returns

returns['Returns'] = prices_df.pct_change().mean() * 252

# Define the column Volatility

returns['Volatility'] = prices_df.pct_change().std() * sqrt(252)

- Let’s look at the Elbow Curve

# Format the data as a numpy array to feed into the K-Means algorithm

data = np.asarray([np.asarray(returns['Returns']),np.asarray(returns['Volatility'])]).T

X = data

distorsions = []

for k in range(2, 7):

k_means = KMeans(n_clusters=k)

k_means.fit(X)

distorsions.append(k_means.inertia_)

fig = plt.figure(figsize=(10, 5))

plt.rcParams.update({'font.size': 20})

plt.plot(range(2, 7), distorsions,lw=4)

plt.grid(True)

plt.xlabel('Cluster Number')

plt.ylabel('Distortions')

plt.title('S&P 500 Elbow Curve')

- Performing the K-means cluster analysis with K=4

# Computing K-Means with K = 4 (4 clusters)

centroids,_ = kmeans(data,4)

# Assign each sample to a cluster

idx,_ = vq(data,centroids)

# Create a dataframe with the tickers and the clusters that's belong to

details = [(name,cluster) for name, cluster in zip(returns.index,idx)]

details_df = pd.DataFrame(details)

# Rename columns

details_df.columns = ['Ticker','Cluster']

# Create another dataframe with the tickers and data from each stock

clusters_df = returns.reset_index()

# Bring the clusters information from the dataframe 'details_df'

clusters_df['Cluster'] = details_df['Cluster']

# Rename columns

clusters_df.columns = ['Ticker', 'Returns', 'Volatility', 'Cluster']

- Using Plotly for plotting volatility-returns domain K-means clusters of the S&P 500 stocks 2023

# Plot the clusters created using Plotly

#fig.update_traces(marker={'size': 82})

fig = px.scatter(clusters_df, x="Returns", y="Volatility", color="Cluster")

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=15)

fig.update_layout(

title="S&P 500 Stocks K-Means Clusters",

xaxis_title="Returns",

yaxis_title="Volatility",

legend_title="Legend Title",

font=dict(

family="Courier New, monospace",

size=18,

color="RebeccaPurple"

)

)

fig.show()

- Plotting the above stock clusters with tickers

# Plot the clusters created using Plotly

fig = px.scatter(clusters_df, x="Returns", y="Volatility", color="Cluster", text="Ticker",hover_data=["Ticker"])

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=10)

fig.update_traces(textposition='top center')

fig.show()

- We can identify and remove 3 groups of stock outliers ranked in terms of min/max returns and high volatility

# Identify and remove the outliers of stocks

returns.drop('NVDA',inplace=True) #highest return

returns.drop('TSLA',inplace=True) #high return

returns.drop('META',inplace=True) #high return

returns.drop('CTLT',inplace=True) #high volatility

returns.drop('ZION',inplace=True) #high volatility

returns.drop('CMA',inplace=True) #high volatility

returns.drop('DG',inplace=True) #low return

returns.drop('ENPH',inplace=True) #negative return

returns.drop('SEDG',inplace=True) #negative return

returns.drop('VLTO',inplace=True) #most negative return

# Recreate data to feed into the algorithm

data = np.asarray([np.asarray(returns['Returns']),np.asarray(returns['Volatility'])]).T

# Computing K-Means with K = 4 (4 clusters)

centroids,_ = kmeans(data,4)

# Assign each sample to a cluster

idx,_ = vq(data,centroids)

# Create a dataframe with the tickers and the clusters that's belong to

details = [(name,cluster) for name, cluster in zip(returns.index,idx)]

details_df = pd.DataFrame(details)

# Rename columns

details_df.columns = ['Ticker','Cluster']

# Create another dataframe with the tickers and data from each stock

clusters_df = returns.reset_index()

# Bring the clusters information from the dataframe 'details_df'

clusters_df['Cluster'] = details_df['Cluster']

# Rename columns

clusters_df.columns = ['Ticker', 'Returns', 'Volatility', 'Cluster']

# Plot the clusters created using Plotly

fig = px.scatter(clusters_df, x="Returns", y="Volatility", color="Cluster", text="Ticker",hover_data=["Ticker"])

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=10)

fig.update_traces(textposition='top center')

fig.show()

- Plot S&P 500 stock cluster 0

clusters1_df = clusters_df.loc[clusters_df['Cluster'] == 0]

# Plot the clusters created using Plotly

fig = px.scatter(clusters1_df, x="Returns", y="Volatility", text="Ticker",hover_data=["Ticker"])

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=10)

fig.update_traces(textposition='top center')

fig.update_traces(marker=dict(color='blue'))

fig.update_layout(

height=800,

title_text='S&P500 Stock Cluster 0',font=dict(size=15)

)

fig.update_layout(

yaxis = dict(

tickfont = dict(size=20)))

fig.update_layout(

xaxis = dict(

tickfont = dict(size=20)))

fig.show()

- Plot S&P 500 stock cluster 1

clusters1_df = clusters_df.loc[clusters_df['Cluster'] == 1]

# Plot the clusters created using Plotly

fig = px.scatter(clusters1_df, x="Returns", y="Volatility", text="Ticker",hover_data=["Ticker"])

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=10)

fig.update_traces(textposition='top center')

fig.update_traces(marker=dict(color='purple'))

fig.update_layout(

height=800,

title_text='S&P500 Stock Cluster 1',font=dict(size=15)

)

fig.update_layout(

yaxis = dict(

tickfont = dict(size=20)))

fig.update_layout(

xaxis = dict(

tickfont = dict(size=20)))

fig.show()

- Plot S&P 500 stock cluster 2

clusters1_df = clusters_df.loc[clusters_df['Cluster'] == 2]

# Plot the clusters created using Plotly

fig = px.scatter(clusters1_df, x="Returns", y="Volatility", text="Ticker",hover_data=["Ticker"])

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=10)

fig.update_traces(textposition='top center')

fig.update_traces(marker=dict(color='orange'))

fig.update_layout(

height=800,

title_text='S&P500 Stock Cluster 2',font=dict(size=15)

)

fig.update_layout(

yaxis = dict(

tickfont = dict(size=20)))

fig.update_layout(

xaxis = dict(

tickfont = dict(size=20)))

fig.show()

- Plot S&P 500 stock cluster 3

clusters1_df = clusters_df.loc[clusters_df['Cluster'] == 3]

# Plot the clusters created using Plotly

fig = px.scatter(clusters1_df, x="Returns", y="Volatility", text="Ticker",hover_data=["Ticker"])

fig.update(layout_coloraxis_showscale=False)

fig.update_traces(marker_size=10)

fig.update_traces(textposition='top center')

fig.update_traces(marker=dict(color='yellow'))

fig.update_layout(

height=800,

title_text='S&P500 Stock Cluster 3',font=dict(size=15)

)

fig.update_layout(

yaxis = dict(

tickfont = dict(size=20)))

fig.update_layout(

xaxis = dict(

tickfont = dict(size=20)))

fig.show()

META Price 2023 Anomaly Detection

- As an example, let’s dive into the META stock price 2023 by applying the anomaly detection algorithm.

- Reading the input data and calculating the Minmax scaled stock daily returns

ticker = 'META'

start_date = '2023-01-01'

end_date = '2023-10-24'

stock_data = yf.download(ticker, start=start_date, end=end_date)['Adj Close']

# Create an empty dataframe

returns = pd.DataFrame()

# Define the column Returns

returns['Returns'] = stock_data.pct_change()

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

returns['Returns'] = scaler.fit_transform(returns['Returns'].values.reshape(-1,1))

data=returns.dropna()

data.tail()

Returns

Date

2023-10-17 0.148736

2023-10-18 -0.999300

2023-10-19 -0.677357

2023-10-20 -0.683911

2023-10-23 0.467614

- Let’s invoke the Isolated Forest anomaly detection algorithm with 5% contamination

from sklearn.ensemble import IsolationForest

model = IsolationForest(contamination=0.05)

model.fit(data[['Returns']])

# Predicting anomalies

data['Anomaly'] = model.predict(data[['Returns']])

data['Anomaly'] = data['Anomaly'].map({1: 0, -1: 1})

# Ploting the results

plt.figure(figsize=(20,5))

plt.plot(data.index, data['Returns'], label='Returns')

plt.scatter(data[data['Anomaly'] == 1].index, data[data['Anomaly'] == 1]['Returns'], color='red')

plt.legend(['Returns', 'Anomaly'])

plt.grid()

plt.show()

- For the sake of comparison, let’s consider the TensorFlow Keras anomaly detection algorithm.

- Loading the input data

fb = yf.Ticker("META")

fb_historical = fb.history(start=start_date, end=end_date, interval="1d")

df = fb_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

df1=df.reset_index()

- Importing key libraries

import numpy as np

import tensorflow as tf

import pandas as pd

pd.options.mode.chained_assignment = None

import seaborn as sns

from matplotlib.pylab import rcParams

import matplotlib.pyplot as plt

import plotly.express as px

import plotly.graph_objects as go

%matplotlib inline

sns.set(style='whitegrid', palette='muted')

rcParams['figure.figsize'] = 14, 8

np.random.seed(1)

tf.random.set_seed(1)

print('Tensorflow version:', tf.__version__)

Tensorflow version: 2.10.0

fig = go.Figure()

fig.add_trace(go.Scatter(x=df1.Date, y=df1.Close,

mode='lines',

name='close'))

fig.update_layout(showlegend=True)

fig.show()

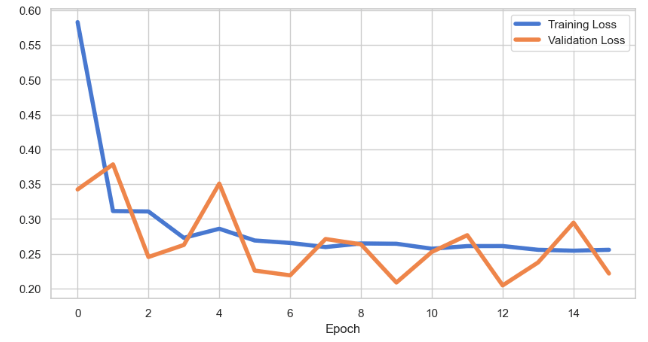

- Preparing the data and training the Keras Sequential LSTM model

df=df1.copy()

train_size = int(len(df) * 0.8)

test_size = len(df) - train_size

train, test = df.iloc[0:train_size], df.iloc[train_size:len(df)]

print(train.shape, test.shape)

(162, 2) (41, 2)

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

scaler = scaler.fit(train[['Close']])

train['Close'] = scaler.transform(train[['Close']])

test['Close'] = scaler.transform(test[['Close']])

def create_dataset(X, y, time_steps=1):

Xs, ys = [], []

for i in range(len(X) - time_steps):

v = X.iloc[i:(i + time_steps)].values

Xs.append(v)

ys.append(y.iloc[i + time_steps])

return np.array(Xs), np.array(ys)

time_steps = 30

X_train, y_train = create_dataset(train[['Close']], train.Close, time_steps)

X_test, y_test = create_dataset(test[['Close']], test.Close, time_steps)

print(X_train.shape)

(132, 30, 1)

timesteps = X_train.shape[1]

num_features = X_train.shape[2]

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense, LSTM, Dropout, RepeatVector, TimeDistributed

model = Sequential([

LSTM(128, input_shape=(timesteps, num_features)),

Dropout(0.2),

RepeatVector(timesteps),

LSTM(128, return_sequences=True),

Dropout(0.2),

TimeDistributed(Dense(num_features))

])

model.compile(loss='mae', optimizer='adam')

model.summary()

Model: "sequential"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm (LSTM) (None, 128) 66560

dropout (Dropout) (None, 128) 0

repeat_vector (RepeatVector (None, 30, 128) 0

)

lstm_1 (LSTM) (None, 30, 128) 131584

dropout_1 (Dropout) (None, 30, 128) 0

time_distributed (TimeDistr (None, 30, 1) 129

ibuted)

=================================================================

Total params: 198,273

Trainable params: 198,273

Non-trainable params: 0

es = tf.keras.callbacks.EarlyStopping(monitor='val_loss', patience=3, mode='min')

history = model.fit(

X_train, y_train,

epochs=100,

batch_size=32,

validation_split=0.1,

callbacks = [es],

shuffle=False

)

plt.rcParams.update({'font.size': 20})

plt.figure(figsize=(10, 5))

plt.plot(history.history['loss'], label='Training Loss',lw=4)

plt.plot(history.history['val_loss'], label='Validation Loss',lw=4)

plt.xlabel('Epoch')

plt.legend();

- Performing model prediction and evaluation

X_train_pred = model.predict(X_train)

train_mae_loss = pd.DataFrame(np.mean(np.abs(X_train_pred - X_train), axis=1), columns=['Error'])

model.evaluate(X_test, y_test)

loss: 0.16311994194984436

- Plotting Train MAE Loss using sns.distplot

ax=sns.distplot(train_mae_loss, bins=50, kde=True);

sns.set(font_scale=2)

sns.set(rc={'figure.figsize':(10,7)})

ax.set(xlabel='Train MAE Loss', ylabel='Density')

- Test data prediction and plotting Test MAE Loss using sns.distplot

X_test_pred = model.predict(X_test)

test_mae_loss = np.mean(np.abs(X_test_pred - X_test), axis=1)

ax=sns.distplot(test_mae_loss, bins=50, kde=True);

ax.set(xlabel='Test MAE Loss', ylabel='Density')

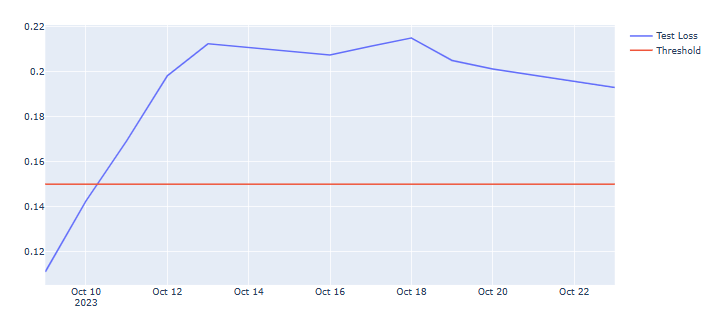

- Let’s look at the test data columns loss, anomaly, and close by applying a constant threshold

THRESHOLD = 0.15

test_score_df = pd.DataFrame(test[time_steps:])

test_score_df['loss'] = test_mae_loss

test_score_df['threshold'] = THRESHOLD

test_score_df['anomaly'] = test_score_df.loss > test_score_df.threshold

test_score_df['close'] = test[time_steps:].Close

fig = go.Figure()

fig.add_trace(go.Scatter(x=test[time_steps:].Date, y=test_score_df.loss,

mode='lines',

name='Test Loss'))

fig.add_trace(go.Scatter(x=test[time_steps:].Date, y=test_score_df.threshold,

mode='lines',

name='Threshold'))

fig.update_layout(showlegend=True)

fig.show()

anomalies = test_score_df[test_score_df.anomaly == True]

anomalies.tail()

import seaborn as sns

import matplotlib as mpl

mpl.rcParams['lines.markersize'] = 18

sns.scatterplot(x='Date', y='close', data=anomalies, hue='anomaly')

3D Cluster Analysis of 3 Leading Tech Stocks in 2023

- Let’s compare the following 3 leading tech stocks in terms of their daily returns in 2023

fb = yf.Ticker("META")

fb_historical = fb.history(start=start_date, end=end_date, interval="1d")

fb_df = fb_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

fb_df.rename(columns= {'Close':'META'}, inplace=True)

tsla= yf.Ticker("TSLA")

tsla_historical = tsla.history(start=start_date, end=end_date, interval="1d")

tsla_df = tsla_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

tsla_df.rename(columns= {'Close':'TSLA'}, inplace=True)

cmg = yf.Ticker("AAPL")

cmg_historical = cmg.history(start=start_date, end=end_date, interval="1d")

cmg_df = cmg_historical.drop(columns=['Open', 'High', 'Low', 'Dividends', 'Stock Splits', 'Volume'])

cmg_df.rename(columns= {'Close':'AAPL'}, inplace=True)

# Concat join tickers into one DataFrame

stocks = pd.concat([fb_df, tsla_df, cmg_df], axis="columns", join="inner")

N,d = stocks.shape

delta = pd.DataFrame(100*np.divide(stocks.iloc[1:,:].values-stocks.iloc[:N-1,:].values, stocks.iloc[:N-1,:].values),

columns=stocks.columns, index=stocks.iloc[1:].index)

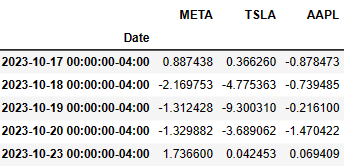

delta.tail()

- Let’s plot their returns in 3D (cf. Three-Dimensional Plotting in Matplotlib)

import matplotlib.pyplot as plt

%matplotlib inline

fig = plt.figure(figsize=(8,5))

ax = plt.axes(projection='3d')

ax.scatter(delta.META,delta.TSLA,delta.AAPL)

ax.set_xlabel('META',labelpad = 15)

ax.set_ylabel('TSLA',labelpad = 15)

ax.set_zlabel('AAPL',labelpad = -35)

plt.show()

- Calculating the mean and covariance values of returns

meanValue = delta.mean()

covValue = delta.cov()

print(meanValue)

print(covValue)

META 0.491357

TSLA 0.393428

AAPL 0.171355

dtype: float64

META TSLA AAPL

META 7.126712 3.642370 1.879189

TSLA 3.642370 11.984574 2.070569

AAPL 1.879189 2.070569 1.713684

- Introducing the anomaly score of these three stocks and plotting them with varying marker color

from numpy.linalg import inv

X = delta.values

S = covValue.values

for i in range(3):

X[:,i] = X[:,i] - meanValue[i]

def mahalanobis(row):

return np.matmul(row,S).dot(row)

anomaly_score = np.apply_along_axis( mahalanobis, axis=1, arr=X)

fig = plt.figure(figsize=(10,6))

ax = fig.add_subplot(111, projection='3d')

p = ax.scatter(delta.META,delta.TSLA,delta.AAPL,c=anomaly_score,cmap='jet')

ax.set_xlabel('META',labelpad = 15)

ax.set_ylabel('TSLA',labelpad = 15)

ax.set_zlabel('AAPL',labelpad = -35)

fig.colorbar(p)

plt.show()

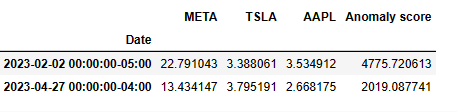

- Let’s compare 2 largest anomaly scores

anom = pd.DataFrame(anomaly_score, index=delta.index, columns=['Anomaly score'])

result = pd.concat((delta,anom), axis=1)

result.nlargest(2,'Anomaly score')

- Let’s define the anomaly score in terms of the KNN distance and plot the result in 3D view

from sklearn.neighbors import NearestNeighbors

import numpy as np

from scipy.spatial import distance

knn = 4

nbrs = NearestNeighbors(n_neighbors=knn, metric=distance.euclidean).fit(delta.values)

distances, indices = nbrs.kneighbors(delta.values)

anomaly_score = distances[:,knn-1]

fig = plt.figure(figsize=(10,6))

ax = fig.add_subplot(111, projection='3d')

p = ax.scatter(delta.META,delta.TSLA,delta.AAPL,c=anomaly_score,cmap='jet')

ax.set_xlabel('META',labelpad = 15)

ax.set_ylabel('TSLA',labelpad = 15)

ax.set_zlabel('AAPL',labelpad = -35)

fig.colorbar(p)

plt.show()

- Examining the top 5 anomaly scores in 2023

anom = pd.DataFrame(anomaly_score, index=delta.index, columns=['Anomaly score'])

result = pd.concat((delta,anom), axis=1)

result.nlargest(5,'Anomaly score')

LSTM Anomalies of S&P 500 Index Historical Prices – Round 1

- We continue evaluating the S&P 500 index in terms of the Anomaly Detection in Time Series with Keras. In doing so, let’s turn our attention to the historical S&P 500 data

df = pd.read_csv('S&P_500_Index_Data.csv', parse_dates=['date'])

df.tail()

date close

8187 2018-06-25 2717.07

8188 2018-06-26 2723.06

8189 2018-06-27 2699.63

8190 2018-06-28 2716.31

8191 2018-06-29 2718.37

df.shape

(8192, 2)

fig = go.Figure()

fig.add_trace(go.Scatter(x=df.date, y=df.close,

mode='lines',

name='close'))

fig.update_layout(showlegend=True)

fig.show()

- Let’s prepare the data and train the model

train_size = int(len(df) * 0.8)

test_size = len(df) - train_size

train, test = df.iloc[0:train_size], df.iloc[train_size:len(df)]

print(train.shape, test.shape)

(6553, 2) (1639, 2)

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

scaler = scaler.fit(train[['close']])

train['close'] = scaler.transform(train[['close']])

test['close'] = scaler.transform(test[['close']])

def create_dataset(X, y, time_steps=1):

Xs, ys = [], []

for i in range(len(X) - time_steps):

v = X.iloc[i:(i + time_steps)].values

Xs.append(v)

ys.append(y.iloc[i + time_steps])

return np.array(Xs), np.array(ys)

time_steps = 30

X_train, y_train = create_dataset(train[['close']], train.close, time_steps)

X_test, y_test = create_dataset(test[['close']], test.close, time_steps)

print(X_train.shape)

(6523, 30, 1)

timesteps = X_train.shape[1]

num_features = X_train.shape[2]

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense, LSTM, Dropout, RepeatVector, TimeDistributed

model = Sequential([

LSTM(128, input_shape=(timesteps, num_features)),

Dropout(0.2),

RepeatVector(timesteps),

LSTM(128, return_sequences=True),

Dropout(0.2),

TimeDistributed(Dense(num_features))

])

model.compile(loss='mae', optimizer='adam')

model.summary()

Model: "sequential_3"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_6 (LSTM) (None, 128) 66560

dropout_6 (Dropout) (None, 128) 0

repeat_vector_3 (RepeatVect (None, 30, 128) 0

or)

lstm_7 (LSTM) (None, 30, 128) 131584

dropout_7 (Dropout) (None, 30, 128) 0

time_distributed_3 (TimeDis (None, 30, 1) 129

tributed)

=================================================================

Total params: 198,273

Trainable params: 198,273

Non-trainable params: 0

es = tf.keras.callbacks.EarlyStopping(monitor='val_loss', patience=3, mode='min')

history = model.fit(

X_train, y_train,

epochs=100,

batch_size=32,

validation_split=0.1,

callbacks = [es],

shuffle=False

)

from matplotlib.pyplot import figure

figure(figsize=(10, 5))

plt.rcParams.update({'font.size': 20})

plt.plot(history.history['loss'], label='Training Loss',lw=4)

plt.plot(history.history['val_loss'], label='Validation Loss',lw=4)

plt.xlabel('Epoch')

plt.legend();

- Performing train/test data predictions and validation

X_train_pred = model.predict(X_train)

train_mae_loss = pd.DataFrame(np.mean(np.abs(X_train_pred - X_train), axis=1), columns=['Error'])

model.evaluate(X_test, y_test)

loss: 0.8965740203857422

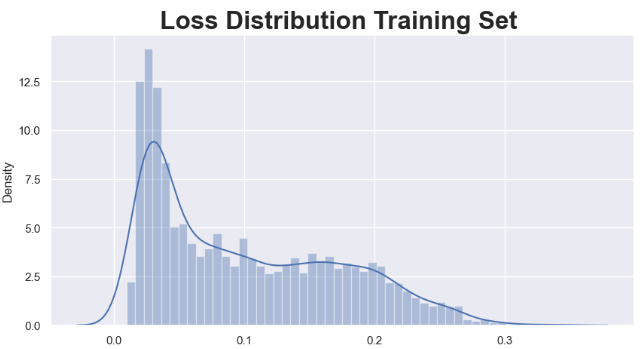

- Density plot Train MAE Loss

ax=sns.distplot(train_mae_loss, bins=50, kde=True);

sns.set(font_scale=4)

sns.set(rc={'figure.figsize':(10,7)})

ax.set(xlabel='Train MAE Loss', ylabel='Density')

- Test data prediction

X_test_pred = model.predict(X_test)

test_mae_loss = np.mean(np.abs(X_test_pred - X_test), axis=1)

- Density plot Test MAE Loss

ax=sns.distplot(test_mae_loss, bins=50, kde=True);

sns.set(font_scale=4)

sns.set(rc={'figure.figsize':(10,7)})

ax.set(xlabel='Test MAE Loss', ylabel='Density')

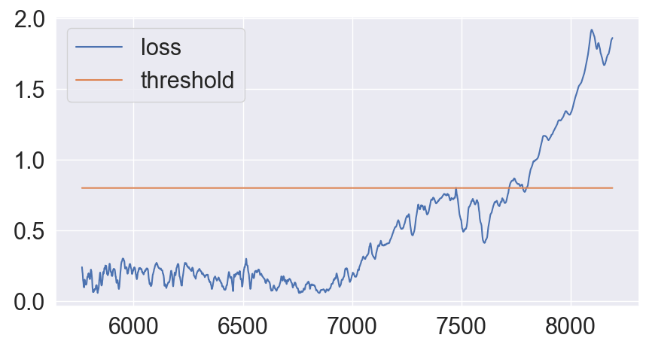

- Applying a constant threshold to Test Loss and plot the result

THRESHOLD = 1.32

test_score_df = pd.DataFrame(test[time_steps:])

test_score_df['loss'] = test_mae_loss

test_score_df['threshold'] = THRESHOLD

test_score_df['anomaly'] = test_score_df.loss > test_score_df.threshold

test_score_df['close'] = test[time_steps:].close

fig = go.Figure()

fig.add_trace(go.Scatter(x=test[time_steps:].date, y=test_score_df.loss,

mode='lines',

name='Test Loss'))

fig.add_trace(go.Scatter(x=test[time_steps:].date, y=test_score_df.threshold,

mode='lines',

name='Threshold'))

fig.update_layout(showlegend=True)

fig.show()

- Creating the anomaly score

anomalies = test_score_df[test_score_df.anomaly == True]

anomalies.tail()

date loss threshold anomaly close

8187 2018-06-25 1.848737 0.8 True 4.453261

8188 2018-06-26 1.852082 0.8 True 4.467213

8189 2018-06-27 1.854868 0.8 True 4.412640

8190 2018-06-28 1.858325 0.8 True 4.451491

8191 2018-06-29 1.860025 0.8 True 4.456289

- Plotting the anomalies

sns.scatterplot(x='date', y='close', data=anomalies, hue='anomaly')

LSTM Anomalies of S&P 500 Index Historical Prices – Round 2

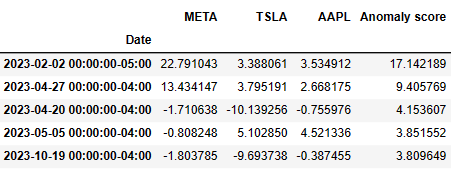

- Let’s have an alternative look at the LSTM model of automated anomaly detection using the closing prices for S&P 500 index from 1986 to 2018, viz.

df = pd.read_csv('S&P_500_Index_Data.csv', parse_dates=['date'])

anomaly_df = df.copy()

fig = plt.figure(figsize=(10,6))

plt.style.use('ggplot')

ax = fig.add_subplot()

ax.plot(anomaly_df['date'],anomaly_df['close'], label='Close Price')

ax.set_title('S&P 500 Daily Prices 1986 - 2018', fontweight = 'bold')

plt.rcParams.update({'font.size': 20})

ax.set_xlabel('Year')

ax.set_ylabel('Dollars ($)')

ax.legend()

- Preparing the data for training the LSTM model

train_size = int(len(anomaly_df) * 0.7)

test_size = len(anomaly_df) - train_size

train, test = anomaly_df.iloc[0:train_size], anomaly_df.iloc[train_size:len(anomaly_df)]

scaler = StandardScaler()

scaler = scaler.fit(train[['close']])

train['close'] = scaler.transform(train[['close']])

test['close'] = scaler.transform(test[['close']])

#Create helper function

def create_dataset(X, y, time_steps=1):

Xs, ys = [], []

for i in range(len(X) - time_steps):

v = X.iloc[i:(i + time_steps)].values

Xs.append(v)

ys.append(y.iloc[i + time_steps])

return np.array(Xs), np.array(ys)

TIME_STEPS = 30

# reshape to [samples, time_steps, n_features]

X_train, y_train = create_dataset(train[['close']], train.close, TIME_STEPS)

X_test, y_test = create_dataset(test[['close']], test.close, TIME_STEPS)

- Training the LSTM model

model = keras.Sequential()

#encoder

model.add(keras.layers.LSTM(

units=64,

input_shape=(X_train.shape[1], X_train.shape[2])

))

model.add(keras.layers.Dropout(rate=0.2))

#decoder

model.add(keras.layers.RepeatVector(n=X_train.shape[1]))

model.add(keras.layers.LSTM(units=64, return_sequences=True))

model.add(keras.layers.Dropout(rate=0.2))

model.add(keras.layers.TimeDistributed(keras.layers.Dense(units=X_train.shape[2])))

model.compile(loss='mae', optimizer='adam')

model.summary()

Model: "sequential_6"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_12 (LSTM) (None, 64) 16896

dropout_12 (Dropout) (None, 64) 0

repeat_vector_6 (RepeatVect (None, 30, 64) 0

or)

lstm_13 (LSTM) (None, 30, 64) 33024

dropout_13 (Dropout) (None, 30, 64) 0

time_distributed_6 (TimeDis (None, 30, 1) 65

tributed)

=================================================================

Total params: 49,985

Trainable params: 49,985

Non-trainable params: 0

_________________________________________________________________

history = model.fit(

X_train, y_train,

epochs=10,

batch_size=64,

validation_split=0.3,

shuffle=False

)

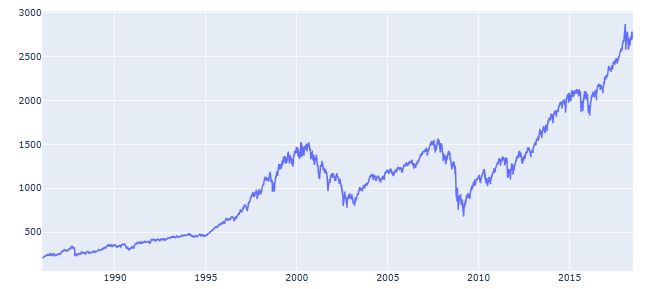

fig = plt.figure(figsize=(10,6))

ax = fig.add_subplot()

import matplotlib

#matplotlib.rcParams.update({'font.size': 22})

SMALL_SIZE = 18

MEDIUM_SIZE = 18

BIGGER_SIZE = 18

plt.rc('font', size=SMALL_SIZE) # controls default text sizes

plt.rc('axes', titlesize=SMALL_SIZE) # fontsize of the axes title

plt.rc('axes', labelsize=MEDIUM_SIZE) # fontsize of the x and y labels

plt.rc('xtick', labelsize=SMALL_SIZE) # fontsize of the tick labels

plt.rc('ytick', labelsize=SMALL_SIZE) # fontsize of the tick labels

plt.rc('legend', fontsize=SMALL_SIZE) # legend fontsize

plt.rc('figure', titlesize=BIGGER_SIZE) # fontsize of the figure title

ax.plot(history.history['loss'], label='train',lw=4)

ax.plot(history.history['val_loss'], label='test',lw=4)

plt.xlabel('Epoch')

ax.legend()

- LSTM Model predictions on train data

X_train_pred = model.predict(X_train)

train_mae_loss = np.mean(np.abs(X_train_pred - X_train), axis=1)

fig = plt.figure(figsize=(10,5))

sns.set(style="darkgrid")

ax = fig.add_subplot()

sns.set(font_scale=2)

sns.distplot(train_mae_loss, bins=50, kde=True)

ax.set_title('Loss Distribution Training Set ', fontweight ='bold')

- LSTM Model predictions on test data

X_test_pred = model.predict(X_test)

test_mae_loss = np.mean(np.abs(X_test_pred - X_test), axis=1)

fig = plt.figure(figsize=(10,5))

sns.set(style="darkgrid")

ax = fig.add_subplot()

sns.set(font_scale=2)

sns.distplot(test_mae_loss, bins=50, kde=True)

ax.set_title('Loss Distribution Test Set ', fontweight ='bold')

- Applying the constant threshold technique

THRESHOLD = 0.8

test_score_df = pd.DataFrame(index=test[TIME_STEPS:].index)

test_score_df['date'] = test['date']

test_score_df['loss'] = test_mae_loss

test_score_df['threshold'] = THRESHOLD

test_score_df['anomaly'] = test_score_df.loss > test_score_df.threshold

test_score_df['close'] = test[TIME_STEPS:].close

fig = plt.figure(figsize=(10,5))

ax = fig.add_subplot()

ax.plot(test_score_df.index, test_score_df.loss, label='loss')

ax.plot(test_score_df.index, test_score_df.threshold, label='threshold')

ax.legend()

- Plot of test data anomalies vs loss factor

anomalies = test_score_df[test_score_df.anomaly == True]

anomalies.index=test_score_df[test_score_df.anomaly == True].index

anomalies.tail()

date loss threshold anomaly close

8187 2018-06-25 1.848737 0.8 True 4.453261

8188 2018-06-26 1.852082 0.8 True 4.467213

8189 2018-06-27 1.854868 0.8 True 4.412640

8190 2018-06-28 1.858325 0.8 True 4.451491

8191 2018-06-29 1.860025 0.8 True 4.456289

fig = plt.figure(figsize=(14,5))

plt.plot(test['date'],test['close'])

sns.scatterplot(data=anomalies, x="date", y="close", hue="loss",s=170)

Summary

- Anomaly detection involves identifying data points in the data that doesn’t fit the normal pattern. Using AI-powered methods we can automate this process making it more effective especially when large datasets are involved.

- In our approach, we simply ask if the stock price fits the normal pattern by detecting collective outliers.

- We have implemented both unsupervised and supervised ML algorithms that perform clustering and detect anomalies in stock prices.

- The entire workflow was tested on S&P500 data. It consists of the following steps:

- Uploading the input dataset, splitting the dataset into training/testing subsets.

- Data preparation: scale and reshape our data for the model training.

- Create and train the model

- Train/test data predictions and calculation of MAE loss

- Applying the constant threshold technique.

- The LSTM algorithm detects anomalous data points in the test set that exceed the

reconstruction error threshold. - The trained model found that some low and high S&P 500 price anomalies linked to fluctuating bullish and bearish expectations.

References

- Facundo Joel Allia Fernandez, 2023, Clasificación de acciones mediante k-means clustering. Available at SSRN: https://ssrn.com/abstract=4403662

- Stock classification using k-means clustering

- Anomaly Detection on Google Stock Data 2014-2022

- Anomaly Detection

Explore More

- S&P 500 Algorithmic Trading with FBProphet

- Predicting Rolling Volatility of the NVIDIA Stock – GARCH vs XGBoost

- Optimizing NVIDIA Returns-Drawdowns MVA Crossovers vs Simple RNN Mean Reversal Trading Strategies in Python

- IQR-Based Log Price Volatility Ranking of Top 19 Blue Chips

- Blue-Chip Stock Portfolios for Quant Traders

- Risk-Return Analysis and LSTM Price Predictions of 4 Major Tech Stocks in 2023

One-Time

Monthly

Yearly

Make a one-time donation

Make a monthly donation

Make a yearly donation

Choose an amount

€5.00

€15.00

€100.00

€5.00

€15.00

€100.00

€5.00

€15.00

€100.00

Or enter a custom amount

€

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearly

Leave a comment