- The objective of this post is to predict the STD-related volatility of the NVIDIA stock by comparing the following two TSA models in Python: (1) the Generalized Autoregressive Conditional Heteroscedasticity (GARCH) statistical forecast model and (2) the Extreme Gradient Boosting (XGBoost) supervised Machine Learning (ML) model.

- The GARCH model describes the time-varying variance of financial time series data. It is commonly used to model volatility of financial returns, and can be used to make predictions of volatility.

- XGBoost regression is the most famous ML algorithm to handle different types of structured data. Using trading technical indicators (TTIs) as features, one can employ XGBoost to predict future stock trends and prices.

Table of Contents

- Why NVIDIA

- Basic Imports

- Input NVIDIA Stock Data

- NVIDIA Stock Volatility Analysis

- GARCH Volatility Prediction

- XGBoost Volatility Prediction

- GARCH vs XGBoost Comparisons

- Summary

- Explore More

Why NVIDIA

NVIDIA reported revenue for the Q2 ended July 30, 2023, of $13.51 billion, up 101% from a year ago and up 88% from the previous quarter. GAAP earnings per diluted share for the quarter were $2.48, up 854% from a year ago and up 202% from the previous quarter. Non-GAAP earnings per diluted share were $2.70, up 429% from a year ago and up 148% from the previous quarter.

- NVIDIA stock is expected to more than double within the next year (The Motley Fool)

- Zacks: Zacks’ proprietary data indicates that NVIDIA Corporation is currently rated as a Zacks Rank 1 and we are expecting an above average return from the NVDA shares relative to the market in the next few months. In addition, NVIDIA Corporation has a VGM Score of C (this is a weighted average of the individual Style Scores which allow you to focus on the stocks that best fit your personal trading style). Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of A.

- Stock Analysis: The average analyst rating for NVIDIA stock from 40 stock analysts is “Strong Buy”.

- Riding high on the AI wave, chip giant Nvidia (NVDA), emerged as a winner with its stock surging to record highs, making it the first chip maker to hit $1tn market capitalisation. Nvidia is the powerhouse behind semiconductors that power AI programs like ChatGPT, and saw an uptick in demand and revenues in the latest quarter.

- Trading View NVIDIA Charts & Key Stats:

Market capitalization 1.05TUSD

Dividends yield (FY) 0.04%

Price to earnings Ratio (TTM) 111.35

Basic EPS (TTM) 4.18USD

Net income 4.368BUSD

Revenue 26.974BUSD

Shares float 2.37B

Basic Imports

Let’s set the working directory YOURPATH and import key libraries

import os

os.chdir('YOURPATH') # Set working directory

os. getcwd()

import math

import datetime

import warnings

import numpy as np

import pandas as pd

import plotly.express as px

import plotly.figure_factory as ff

import matplotlib.pyplot as plt

import seaborn as sns

import xgboost as xgb

from arch import arch_model

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

from ipywidgets import HBox, VBox

from tabulate import tabulate

from sklearn.metrics import mean_absolute_percentage_error

from sklearn.metrics import mean_squared_error

from xgboost import plot_importance, plot_tree

#Matplotlib style

plt.style.use('fivethirtyeight')

#Ignoring some warnings

warnings.filterwarnings('ignore')

Input NVIDIA Stock Data

Let’s download the 10Y stock data and perform the preliminary data analysis

import numpy as np

import pandas as pd

import yfinance as yf

import matplotlib.pyplot as plt

import plotly.graph_objs as go

import seaborn as sns

#Download ticker price data from yfinance

tick = 'NVDA'

ticker = yf.Ticker(tick)

ticker_history = ticker.history(period='10y')

ticker_history.tail()

ticker_history.shape

(2517, 7)

ticker_history.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 2517 entries, 2013-10-18 00:00:00-04:00 to 2023-10-18 00:00:00-04:00

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 2517 non-null float64

1 High 2517 non-null float64

2 Low 2517 non-null float64

3 Close 2517 non-null float64

4 Volume 2517 non-null int64

5 Dividends 2517 non-null float64

6 Stock Splits 2517 non-null float64

dtypes: float64(6), int64(1)

memory usage: 157.3 KB

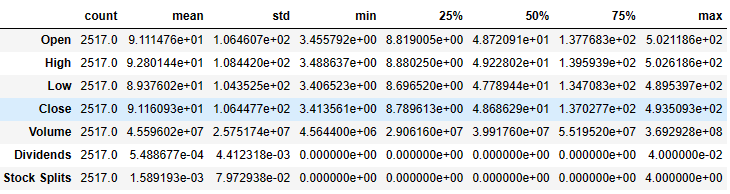

ticker_history.describe().T

NVIDIA Stock Volatility Analysis

#Calculate the percentage change by day

returns_nvd = 100 * ticker_history.Close.pct_change().dropna()

#Drop 0 results, there is a error in the dataset and for 74 days,the stock market was close, so the return is 0

returns_nvd = returns_nvd.drop(returns_nvd[returns_nvd == 0].index)

#Display the 3 first rows of the Serie

returns_nvd.tail()

Date

2023-10-12 00:00:00-04:00 0.296974

2023-10-13 00:00:00-04:00 -3.161152

2023-10-16 00:00:00-04:00 1.394608

2023-10-17 00:00:00-04:00 -4.679468

2023-10-18 00:00:00-04:00 -3.760917

Name: Close, dtype: float64

#Average of return column

returns_nvd.mean()

0.23128969312944928

#Using the raw close prices to plot the evolution of the stock

close_prices = pd.DataFrame(ticker_history["Close"])

#By dividing each close price by the first price in our dataset we calculate the accumulated return for each day

cum_rets = close_prices / close_prices.iloc[0,:]

#Using the plotly.express module we can plot our newly created cum_rets

fig = px.line(cum_rets.iloc[:,:], width=1000, height=500)

#Adding Title

fig.update_layout(title_text='10Y Cumulative Return of NVDA Stock')

#This will print the graph

fig.show()

#The daily volatility is the std of the returns

daily_volatility = returns_nvd.std()

#The monthly volatility is the result of multiplying the daily vol * square root of 21, this is because there are 21 trading days in a month

monthly_volatility = math.sqrt(21) * daily_volatility

#The annual volatility is the result of multiplying the daily vol * square root of 252, this is because there are 252 trading days in a year

annual_volatility = math.sqrt(252) * daily_volatility

#Using tabulate package we can print a nice table

print(tabulate([['nvd',daily_volatility,monthly_volatility,annual_volatility]],headers = ['Daily Volatility %', 'Monthly Volatility %', 'Annual Volatility %'],tablefmt = 'fancy_grid',stralign='center',numalign='center',floatfmt=".2f"))

╒═════╤══════════════════════╤════════════════════════╤═══════════════════════╕

│ │ Daily Volatility % │ Monthly Volatility % │ Annual Volatility % │

╞═════╪══════════════════════╪════════════════════════╪═══════════════════════╡

│ nvd │ 2.92 │ 13.39 │ 46.38 │

╘═════╧══════════════════════╧════════════════════════╧═══════════════════════╛

#We can plot the daily retuns of nvda using a line graph .plot from pandas

returns_nvd.plot(figsize =(16,5), title = 'NVDA Daily Returns');

#We create a distribution plot using plotly.figure_factory, we reshape the data to have them in a vector

return_dist_plot = ff.create_distplot([returns_nvd.values.reshape(-1)], group_labels = [' '])

#We specify the plot layout

return_dist_plot.update_layout(showlegend=False, title_text='Distribution of Daily NVDA Returns', width=1000, height=500)

#Printing the plot

return_dist_plot.show()

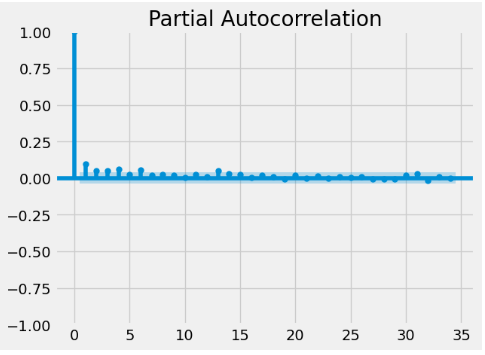

#This code uses the pacf() function from the tsa.stattools module of the statsmodels library (sm) to compute the autocorrelation function.

plot_pacf(returns_nvd**2,method="yw")

#Print the visualization

plt.show()

GARCH Volatility Prediction

#Define a GARCH model (4,4) that uses a ged distribution

model = arch_model(returns_nvd,dist="ged", vol = 'GARCH', p=4, q=4)

#Fit the model

model_fit = model.fit(disp='off')

#Summary of the model

model_fit.summary()

Model Fit Output:

Define the full series as the previosly defined model

full_serie_garch = arch_model(returns_nvd,dist="ged", vol = 'GARCH', p=4, q=4)

#Fitting the model for the full serie

model_fit_full_serie = full_serie_garch.fit(disp='off')

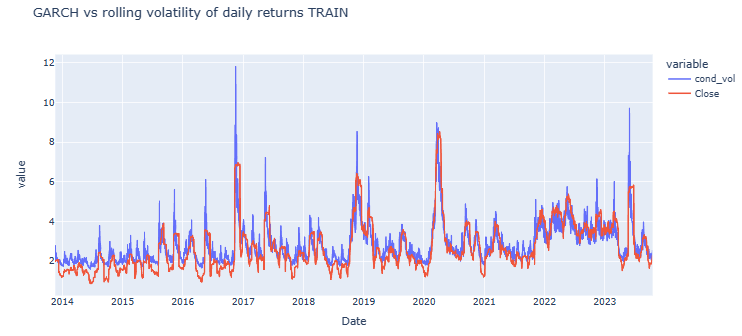

#We will plot against the rolling volatility

rolling_vol = abs(returns_nvd.rolling(window=22, min_periods=22).std().dropna())

#Concatenating the true values, and trained values in our model

garch_and_rolling_std = pd.concat([pd.DataFrame(model_fit_full_serie.conditional_volatility),rolling_vol.dropna()], axis=1).dropna()

#Plotting it

garch_and_rolling_std_plot = px.line(garch_and_rolling_std, title = 'GARCH vs rolling volatility of daily returns TRAIN', width=1000, height=500)

#Printing the plot

garch_and_rolling_std_plot.show()

#Using a numeric range of 251 to fill a list of predicted values, for each day we are fitting a new model with the same parameters, but adding the last day.

test_size = 251

rolling_predictions = []

for i in range(test_size):

train = returns_nvd[:-(test_size-i)]

model = arch_model(train,dist="ged", vol = 'GARCH', p=4, q=4)

model_fit = model.fit(disp='off')

pred = model_fit.forecast(horizon=1, reindex = False)

rolling_predictions.append(np.sqrt(pred.variance.values[-1,:][0]))

#Transforming it to a series

rolling_predictions = pd.Series(rolling_predictions, index= returns_nvd.dropna().index[-test_size:])

#Setting plot parameters

plt.figure(figsize=(10,4))

#True data

true, = plt.plot((rolling_vol)[-test_size:])

#Predicted data

preds, = plt.plot(rolling_predictions)

#Plot of the data

plt.title('Volatility Prediction for the next 251 Trading Days - Rolling Forecast TEST with GARCH(4,4)', fontsize=20)

#Add legend

plt.legend(['True Volatility', 'Predicted Volatility'], fontsize=16)

XGBoost Volatility Prediction

Let’s prepare the data

nvd_stock_raw_data_for_ml = ticker_history.copy()

nvd_stock_raw_data_for_ml.reset_index(inplace=True)

#XGBoost

#We only need the date and close columns

returns_nvd_for_ml = nvd_stock_raw_data_for_ml[["Date","Close"]]

#We change the close column for the percentual change calculation

returns_nvd_for_ml["Close"] = 100 * returns_nvd_for_ml.Close.pct_change().dropna()

#Drop 0 returns

returns_nvd_for_ml = returns_nvd_for_ml.drop(returns_nvd_for_ml[returns_nvd_for_ml["Close"] == 0].index)

#Drop N/A

returns_nvd_for_ml = returns_nvd_for_ml.dropna()

#As we will be comparing it to the rolling volatility of 22 days, we will transform our target to that

returns_nvd_for_ml["Close"] = abs(returns_nvd_for_ml["Close"].rolling(window=22, min_periods=22).std().dropna())

#Convert the date column to datetime format

returns_nvd_for_ml["Date"] = pd.to_datetime(returns_nvd_for_ml["Date"])

#Rename the dataframe

serie_for_xgboost = returns_nvd_for_ml

#Set the test size

test_size = 251

#Split train and test

train_ml = serie_for_xgboost[:-(test_size)].dropna()

test_ml = serie_for_xgboost[-(test_size):].dropna()

#Function for extracting features from date

def create_features(df, label=None):

"""

Creates time series features from datetime index

"""

df['dayofweek'] = df['Date'].dt.dayofweek

df['quarter'] = df['Date'].dt.quarter

df['month'] = df['Date'].dt.month

df['year'] = df['Date'].dt.year

df['dayofyear'] = df['Date'].dt.dayofyear

df['dayofmonth'] = df['Date'].dt.day

X = df[['dayofweek','quarter','month','year',

'dayofyear','dayofmonth']]

if label:

y = df[label]

return X, y

return X

#Creating the features for the train and test sets

X_train, y_train = create_features(train_ml, label="Close")

X_test, y_test = create_features(test_ml, label="Close")

#Defining and fitting the model

reg = xgb.XGBRegressor(n_estimators=1000,early_stopping_rounds=50,)

reg.fit(X_train, y_train,

eval_set=[(X_train, y_train), (X_test, y_test)],

verbose=False)

XGBRegressor

XGBRegressor(base_score=0.5, booster='gbtree', callbacks=None,

colsample_bylevel=1, colsample_bynode=1, colsample_bytree=1,

early_stopping_rounds=50, enable_categorical=False,

eval_metric=None, feature_types=None, gamma=0, gpu_id=-1,

grow_policy='depthwise', importance_type=None,

interaction_constraints='', learning_rate=0.300000012, max_bin=256,

max_cat_threshold=64, max_cat_to_onehot=4, max_delta_step=0,

max_depth=6, max_leaves=0, min_child_weight=1, missing=nan,

monotone_constraints='()', n_estimators=1000, n_jobs=0,

num_parallel_tree=1, predictor='auto', random_state=0, ...)

#Plot of feature importance

_ = plot_importance(reg, height=0.9)

#Predicting with our model for both the train and test data

train_ml["Predictions"] = reg.predict(X_train)

test_ml['Prediction'] = reg.predict(X_test)

#Creating the dataframe with both real and predicted vol

XGBoost_and_rolling = pd.concat([pd.DataFrame(list(train_ml["Predictions"]),list(train_ml["Close"]))], axis=1).dropna().reset_index()

#Renaming columns

XGBoost_and_rolling.rename(columns={"index":"Real_Volatility",0:"Predicted Volatility"}, inplace=True)

XGBoost_and_rolling.head(10)

Real_Volatility Predicted Volatility

0 2.004440 1.991486

1 2.025624 1.995968

2 2.033402 1.981669

3 2.011338 2.058352

4 2.059768 1.995043

5 2.051825 2.018471

6 2.050722 2.058352

7 2.058269 1.981669

8 2.064700 2.006868

9 2.063672 2.006868

#Plotting the predictions of the training data

XGBoost_and_rolling = pd.concat([pd.DataFrame(list(train_ml["Predictions"]),list(train_ml["Close"]))], axis=1).dropna().reset_index()

XGBoost_and_rolling.rename(columns={"index":"Real_Volatility",0:"Predicted Volatility"}, inplace=True)

XGBoost_and_rolling = px.line(XGBoost_and_rolling, title = 'XGBOOST vs Rolling Volatility of Daily Returns TRAIN', width=1000, height=500)

XGBoost_and_rolling.show()

#Plotting the predictions for the test data

plt.figure(figsize=(10,4))

true, = plt.plot(test_ml["Close"])

preds, = plt.plot(test_ml['Prediction'])

plt.title('Volatility Prediction for the next 251 Trading Days - Rolling Forecast TEST with XGBOOST', fontsize=20)

plt.legend(['True Returns', 'Predicted Volatility'], fontsize=16)

GARCH vs XGBoost Comparisons

Let’s compare GARCH vs XGBoost results:

- GARCH model

RMSE_Serie = mean_squared_error(garch_and_rolling_std["Close"],garch_and_rolling_std["cond_vol"],squared=False)

MAPE_Serie = mean_absolute_percentage_error(garch_and_rolling_std["Close"], garch_and_rolling_std["cond_vol"])

print(f"The RMSE of our GARCH model in the full series data is {round(RMSE_Serie,4)}")

print(f"The MAPE of our GARCH model in the full series data is {round(MAPE_Series*100,2)}%")

The RMSE of our GARCH model in the full series data is 0.5975

The MAPE of our GARCH model in the full series data is 19.5%

true_vol = rolling_vol[-test_size:]

pred_vol = rolling_predictions

RMSE = mean_squared_error(true_vol, pred_vol,squared=False)

MAPE = mean_absolute_percentage_error(true_vol, pred_vol)

print(f"The RMSE of our GARCH model in the predicted data is {round(RMSE,4)}")

print(f"The MAPE of our GARCH model in the predicted data is {round(MAPE*100,2)}%")

The RMSE of our GARCH model in the predicted data is 0.7267

The MAPE of our GARCH model in the predicted data is 14.72%

- XGBOOST model

RMSE_Serie_XG = mean_squared_error(train_ml["Close"],train_ml["Predictions"],squared=False)

MAPE_Serie_XG = mean_absolute_percentage_error(train_ml["Close"], train_ml["Predictions"])

print(f"The RMSE of our XGBOOST model in the full series data is {round(RMSE_Serie_XG,4)}")

print(f"The MAPE of our XGBOOST model in the full series data is {round(MAPE_Serie_XG*100,2)}%")

The RMSE of our XGBOOST model in the full series data is 0.1482

The MAPE of our XGBOOST model in the full series data is 3.72%

true_vol = test_ml['Prediction']

pred_vol = test_ml["Close"]

RMSE_XG = mean_squared_error(true_vol, pred_vol,squared=False)

MAPE_XG = mean_absolute_percentage_error(true_vol, pred_vol)

print(f"The RMSE of our XGBOOST model in the predicted data is {round(RMSE_XG,4)}")

print(f"The MAPE of our XGBOOST model in the predicted data is {round(MAPE_XG*100,2)}%")

The RMSE of our XGBOOST model in the predicted data is 0.3728

The MAPE of our XGBOOST model in the predicted data is 5.76%

- GARCH vs XGBOOST

print(tabulate([['MAPE',round(MAPE_Serie*100,2),round(MAPE_Serie_XG*100,2),round(MAPE*100,2),round(MAPE_XG*100,2)]],headers = ['GARCH TRAIN %', 'XGBOOST TRAIN %', 'GARCH PREDICTIONS %','XGBOOST PREDICTIONS %'],tablefmt = 'fancy_grid',stralign='center',numalign='center',floatfmt=".2f"))

╒══════╤═════════════════╤═══════════════════╤═══════════════════════╤═════════════════════════╕

│ │ GARCH TRAIN % │ XGBOOST TRAIN % │ GARCH PREDICTIONS % │ XGBOOST PREDICTIONS % │

╞══════╪═════════════════╪═══════════════════╪═══════════════════════╪═════════════════════════╡

│ MAPE │ 19.22 │ 2.01 │ 14.67 │ 7.19 │

╘══════╧═════════════════╧═══════════════════╧═══════════════════════╧═════════════════════════╛

Summary

- The GARCH and XGBoost models have been used to predict the NVDA volatility.

- GARCH is a widely-used statistical model for forecasting the variance of financial time series.

- A comparison of GARCH and XGBoost in terms of MAPE and RMSE has been accomplished.

- Results show that the XGBoost model is able to accurately predict the rolling monthly volatility of NVDA and outperforms the GARCH model in out-of-sample forecasting.

- This project supports previous studies in that it demonstrates the usefulness of supervised ML in stock volatility forecasting and highlights the importance of considering the time-varying nature of volatility in quantitative financial analysis.

Explore More

- Predicting Volatility: GARCH vs XGBoost

- IQR-Based Log Price Volatility Ranking of Top 19 Blue Chips

- Multiple-Criteria Technical Analysis of Blue Chips in Python

- Blue-Chip Stock Portfolios for Quant Traders

- Are Blue Chips Perfect for This Bear Market?

Make a one-time donation

Make a monthly donation

Make a yearly donation

Choose an amount

Or enter a custom amount

Your contribution is appreciated.

Your contribution is appreciated.

Your contribution is appreciated.

DonateDonate monthlyDonate yearly

Leave a comment